Dive deep into the intrinsic value of a business using our Owner's Earnings Calculation Template. Harness the analytical prowess of the Bruce Greenwald method and the comprehensive All CapEx method to derive true owner's earnings. Elevate your valuation approach with precision and insight.

Introduction

Understanding a company's true earnings from the perspective of an owner is fundamental to astute investing. With the Owner's Earnings Calculation Template, you get access to two revered approaches: the nuanced Bruce Greenwald method and the thorough All CapEx method. By tapping into these methodologies, you can gauge the genuine cash-generating capacity of a business, ensuring your investment evaluations are grounded in solid financial analysis.

Why Our Owner's Earnings Calculation Template is Essential

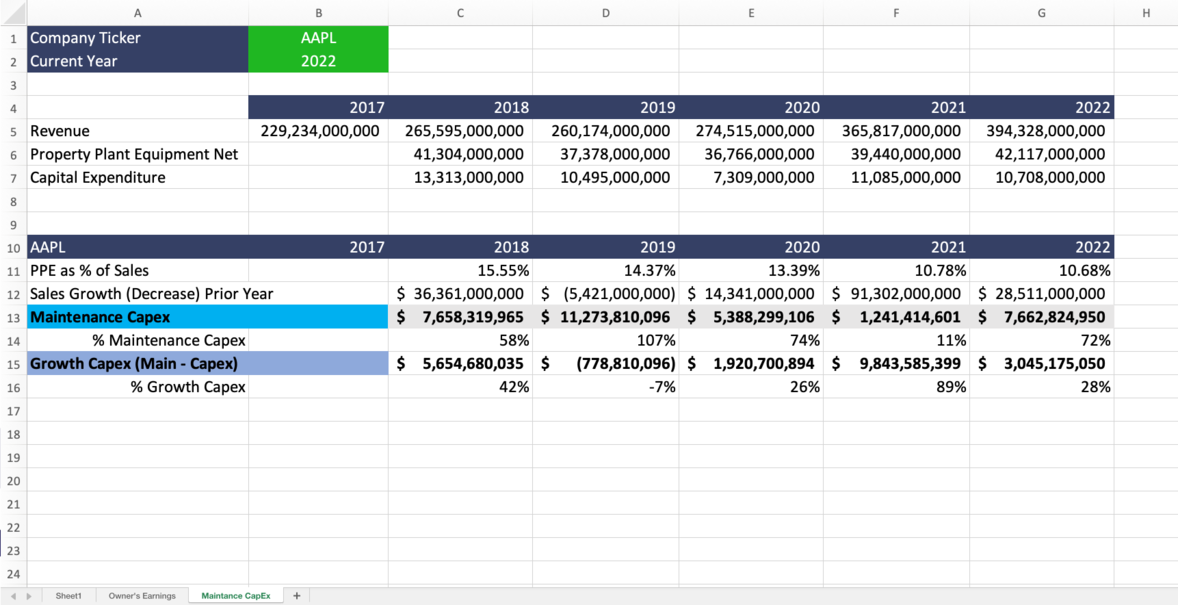

- Bruce Greenwald Method Integration: Delve into a method that considers equity earnings and maintenance capital expenditures.

- All CapEx Method: Gain insights by looking at all capital expenditures without differentiation.

- User-Friendly Interface: Navigate seamlessly through calculations and metrics.

- Historical Data Analysis: Compare owner's earnings over the years for trend analysis.

- Customizable Inputs: Tailor the template to your specific needs, ensuring accuracy and relevance.

- Free Access: Quality financial insights shouldn’t break the bank. You can use this template for free; you just need to copy-paste the data from anywhere on the web or use the Wisesheets add-on to get the data automatically. (Get your free trial here).

Key Features

- Detailed Earnings Breakdown: Understand earnings components like net income, depreciation, and changes in working capital.

- Maintenance CapEx Insights: Differentiate between growth and maintenance capital expenditures.

- Comparative Analysis Tools: Evaluate multiple companies side-by-side for informed investment decisions.

- Guided Workflow: Step-by-step guidance ensures even novices can perform advanced calculations.

Perfect For

- Value Investors: Analyze potential investments through the lens of true owner's earnings.

- Financial Analysts: Add depth to your company evaluations with proven methodologies.

- Academic Researchers: Explore the dynamics of owner's earnings in various industries.

- Investment Bankers: Advise clients with data-backed insights into a company's genuine earnings potential.

User Testimonials

"The Owner's Earnings Calculation Template has been instrumental in refining my investment approach. The integration of both the Greenwald and All CapEx methods offers unparalleled depth." - Sophie L.

"For a clear picture of a company's real earnings, this template is indispensable. It's transformed how I view potential investments." - Derek J.

FAQs

Q: How do I differentiate between growth and maintenance CapEx using the Greenwald method?

A: Our template provides a guided approach, offering clear differentiation based on company disclosures and industry benchmarks. You can switch back and forth between the two methods.

Other powerful templates

Stock Analysis Tool

Roaring Kitty-inspired sheet, charts, DCF template, and a ratio analysis sheet.

Simple DCF

A simple DCF to quickly assess the value of a company.

Earnings Power Value Model

Step-by-step earnings power value model calculation.