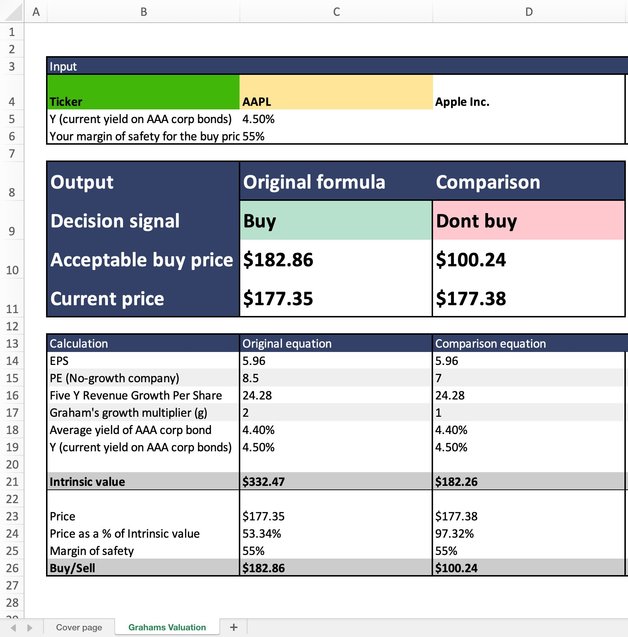

Embrace the legendary insights of Benjamin Graham with our Graham Valuation Formula Template. Streamline your stock evaluation process using the principles of the father of value investing, ensuring your decisions are rooted in proven methodologies and timeless wisdom.

Introduction

In the vast world of stock valuation, few methods have withstood the test of time as effectively as the Graham Valuation Formula. Benjamin Graham, often hailed as the pioneer of value investing, developed a simple yet profound formula to gauge the intrinsic value of stocks. With our Graham Valuation Formula Template, you can effortlessly apply this age-old wisdom to modern stock evaluations, ensuring your investment decisions are both informed and timeless.

Why the Graham Valuation Formula Template is a Must-Have

- Proven Methodology: Utilize a formula trusted by generations of investors, including the likes of Warren Buffett.

- User-Centric Design: Navigate the valuation process with ease, regardless of your experience level.

- Intrinsic Value Insights: Determine the genuine value of a stock, independent of market fluctuations.

- Historical Data Integration: Assess a company's earnings and growth using past performance data.

- Comparative Analysis Tools: Evaluate multiple stocks side-by-side to identify undervalued gems.

- Free Access: Quality financial insights shouldn’t break the bank. You can use this template for free; you just need to copy-paste the data from anywhere on the web or use the Wisesheets add-on to get the data automatically. (Get your free trial here).

Key Features

- Detailed Intrinsic Value Calculations: Apply the Graham formula to derive a stock's true worth.

- Earnings and Growth Input Fields: Input historical data to get accurate valuation results.

- Interactive Summaries: Visualize valuation outcomes for clearer insights.

- Customizable Parameters: Adjust growth multipliers or other factors based on your analysis preferences.

- Guided Workflow: Receive step-by-step guidance, ensuring a smooth valuation process.

Ideal For

- Value Investors: Ground your investment strategy in Graham's timeless principles.

- Financial Analysts: Offer clients data-backed stock evaluations rooted in proven methodologies.

- Academic Researchers: Study stock valuations using a formula with a rich historical context.

- Investment Clubs: Educate members on the foundational principles of value investing.

User Testimonials

"The Graham Valuation Formula Template has revolutionized my stock evaluation process. It's like having Benjamin Graham guiding my investment decisions!" - Elena T.

"For a clear, timeless approach to stock valuation, this template is unparalleled. It's become a cornerstone of my investment strategy." - Rajiv K.

FAQs

Q: Can I customize the Graham formula based on specific industry multipliers?

A: Yes! Our template offers flexibility, allowing you to adjust parameters for industry-specific evaluations.

Q: How does the template account for changing interest rates?

A: The Graham formula considers prevailing interest rates, and our template allows for real-time rate input to ensure accurate valuations.

Other powerful templates

Stock Analysis Tool

Roaring Kitty-inspired sheet, charts, DCF template, and a ratio analysis sheet.

Earnings Power Value Model

Step-by-step earnings power value model calculation.

Simple DCF

A simple DCF to quickly assess the value of a company.