Freja eID Group AB (publ)

FREJA.ST

Price:

$15.25

Market Cap:

$370.34M

Freja eID Group AB (publ), an IT security company, provides security solutions for banking, government, and businesses worldwide. It offers Freja eID, an eco-system for identities; Freja ID to provide secure access to management teams or other key persons; Freja Self-Service Portal, which simplifies the process of user enrolment; Freja Connect, an identity provider that connects internal authentication system to the outside world; Freja Mobile to provide elevated levels of security and user convenience for login and signing; login devices, such as one-button, keyboard, card, USB, and mobile tokens, as well as Freja Mobile, SMS and email, code cards, and Google authenticators; and Pinelope, a...[Read more]

Industry

Software - Infrastructure

IPO Date

2014-12-18

Stock Exchange

STO

Ticker

FREJA.ST

PE Ratio

[-26.29]

ROE

[-142.98%]

Current Ratio

[0.92]

Dividend Yield

[0%]

Enterprise Value

[363.97M]

Dividend History

The ROE as of December 2025 (TTM) for Freja eID Group AB (publ) (FREJA.ST) is -142.98%

According to Freja eID Group AB (publ)’s latest financial reports and current stock price. The company's current ROE is -142.98%. This represents a change of -519.21% compared to the average of 34.11% of the last 4 quarters.

Freja eID Group AB (publ) (FREJA.ST) Historical ROE (quarterly & annually)

How has FREJA.ST ROE performed in the past?

The mean historical ROE of Freja eID Group AB (publ) over the last ten years is -12.14%. The current -142.98% ROE has changed 1.08% with respect to the historical average. Over the past ten years (40 quarters), FREJA.ST's ROE was at its highest in in the September 2024 quarter at 5.82%. The ROE was at its lowest in in the September 2023 quarter at -252.48%.

Average

-12.14%

Median

-90.79%

Minimum

-231.67%

Maximum

857.15%

Freja eID Group AB (publ) (FREJA.ST) ROE by Quarter and Year

Discovering the peaks and valleys of Freja eID Group AB (publ) ROE, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 136.14%

Maximum Annual ROE = 857.15%

Minimum Annual Increase = -849.65%

Minimum Annual ROE = -231.67%

| Year | ROE | Change |

|---|---|---|

| 2024 | 857.15% | -469.99% |

| 2023 | -231.67% | 27.57% |

| 2022 | -181.59% | 105.57% |

| 2021 | -88.34% | -10.88% |

| 2020 | -99.12% | -30.70% |

| 2019 | -143.03% | 88.64% |

| 2018 | -75.82% | -18.68% |

| 2017 | -93.24% | 136.14% |

| 2016 | -39.48% | 50.17% |

| 2015 | -26.29% | -849.65% |

Freja eID Group AB (publ) (FREJA.ST) Average ROE

How has FREJA.ST ROE performed in the past?

The current ROE of Freja eID Group AB (publ) (FREJA.ST) is less than than its 3-year, less than than its 5-year, and greater than its 10-year historical averages

3-year avg

147.96%

5-year avg

51.29%

10-year avg

-12.14%

Freja eID Group AB (publ) (FREJA.ST) ROE vs. Peers

How is FREJA.ST’s ROE compared to its peers?

Freja eID Group AB (publ)’s ROE is less than Sensys Gatso Group AB (publ) (-1.41%), greater than Binero Group AB (publ) (-11.09%), greater than 4C Group AB (publ) (-2.85%), less than Sleep Cycle AB (publ) (84.76%), greater than Tobii AB (publ) (-1.72%), greater than Maven Wireless Sweden AB (Publ) (-5.83%), less than Unibap Space Solutions AB (83.79%), less than B3 Consulting Group AB (publ) (1.22%), less than KebNi AB (publ) (8.64%), less than Qualisys Holding Aktiebolag (0%),

| Company | ROE | Market cap |

|---|---|---|

| -1.41% | $457.76M | |

| -11.09% | $286.19M | |

| -2.85% | $486.09M | |

| 84.76% | $520.12M | |

| -1.72% | $498.71M | |

| -5.83% | $293.98M | |

| 83.79% | $417.60M | |

| 1.22% | $387.25M | |

| 8.64% | $422.01M | |

| 0% | $583.00M |

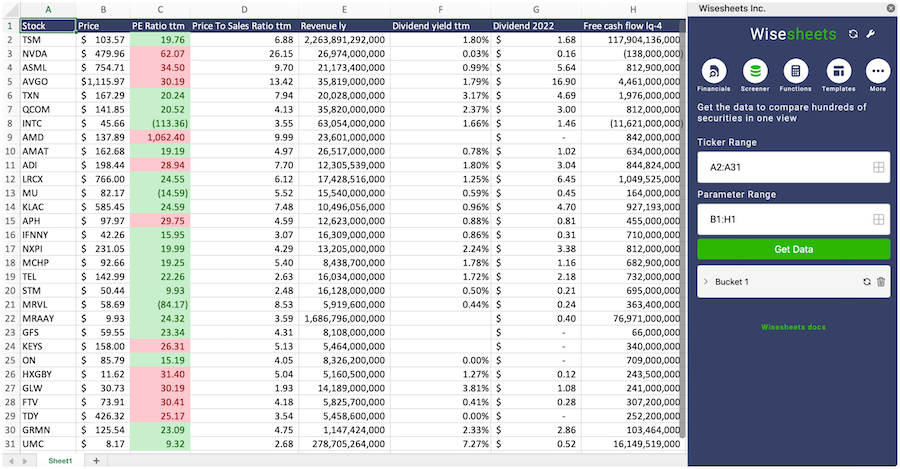

Build a custom stock screener for Freja eID Group AB (publ) (FREJA.ST) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Freja eID Group AB (publ) using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

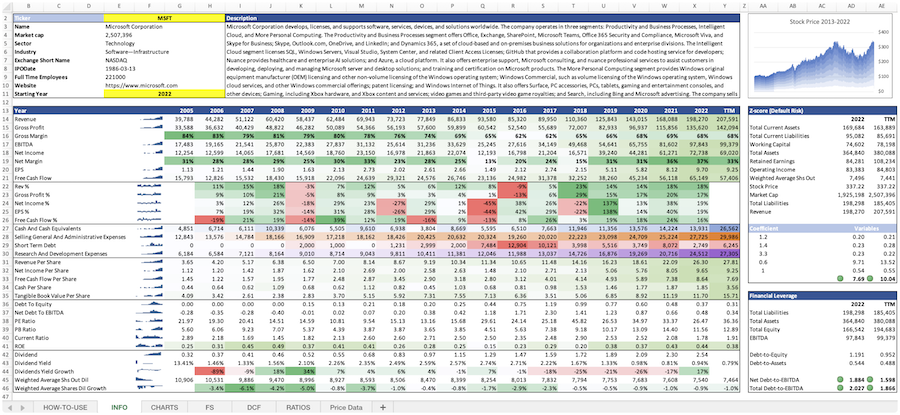

Freja eID Group AB (publ) (FREJA.ST) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Freja eID Group AB (publ) or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the ROE?

How can you use the ROE?

What is Freja eID Group AB (publ)'s ROE?

How is the ROE calculated for Freja eID Group AB (publ) (FREJA.ST)?

What is the highest ROE for Freja eID Group AB (publ) (FREJA.ST)?

What is the 3-year average ROE for Freja eID Group AB (publ) (FREJA.ST)?

What is the 5-year average ROE for Freja eID Group AB (publ) (FREJA.ST)?

How does the current ROE for Freja eID Group AB (publ) (FREJA.ST) compare to its historical average?