Anjani Foods Limited

ANJANIFOODS.BO

Price:

$24.78

Market Cap:

$692.57M

Anjani Foods Ltd. engages in the production and sale of bakery products. The firm operates through the Fresh Choice brand. Its activities include the operation of bakery retail and distribution outlets across five districts from Srikakulam to Godavari, as well as student's cafe in Andhra Pradesh and Telangana. The company was founded on June 25, 1983 and is headquartered in Hyderabad, India.

Industry

Food Confectioners

IPO Date

2010-04-28

Stock Exchange

BSE

Ticker

ANJANIFOODS.BO

PE Ratio

[99.12]

ROE

[4.48%]

Current Ratio

[0.62]

Dividend Yield

[0%]

Enterprise Value

[805.16M]

Dividend History

The ROE as of December 2025 (TTM) for Anjani Foods Limited (ANJANIFOODS.BO) is 4.48%

According to Anjani Foods Limited’s latest financial reports and current stock price. The company's current ROE is 4.48%. This represents a change of 288.60% compared to the average of 1.15% of the last 4 quarters.

Anjani Foods Limited (ANJANIFOODS.BO) Historical ROE (quarterly & annually)

How has ANJANIFOODS.BO ROE performed in the past?

The mean historical ROE of Anjani Foods Limited over the last ten years is 4.27%. The current 4.48% ROE has changed 4.81% with respect to the historical average. Over the past ten years (40 quarters), ANJANIFOODS.BO's ROE was at its highest in in the March 2021 quarter at 15.52%. The ROE was at its lowest in in the June 2016 quarter at -2.97%.

Average

4.27%

Median

3.26%

Minimum

-8.37%

Maximum

24.44%

Anjani Foods Limited (ANJANIFOODS.BO) ROE by Quarter and Year

Discovering the peaks and valleys of Anjani Foods Limited ROE, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 3.43%

Maximum Annual ROE = 24.44%

Minimum Annual Increase = -107.17%

Minimum Annual ROE = -8.37%

| Year | ROE | Change |

|---|---|---|

| 2025 | 9.04% | -2.96% |

| 2024 | 9.31% | 23.55% |

| 2023 | 7.54% | 487.16% |

| 2022 | 1.28% | -94.75% |

| 2021 | 24.44% | 367.28% |

| 2020 | 5.23% | 3.43% |

| 2019 | 0.15% | -107.17% |

| 2018 | -2.07% | -75.27% |

| 2017 | -8.37% | 117.43% |

| 2016 | -3.85% | 20.51% |

Anjani Foods Limited (ANJANIFOODS.BO) Average ROE

How has ANJANIFOODS.BO ROE performed in the past?

The current ROE of Anjani Foods Limited (ANJANIFOODS.BO) is less than than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

8.63%

5-year avg

10.32%

10-year avg

4.27%

Anjani Foods Limited (ANJANIFOODS.BO) ROE vs. Peers

How is ANJANIFOODS.BO’s ROE compared to its peers?

Anjani Foods Limited’s ROE is less than Diligent Industries Limited (4.76%), less than Universal Starch-Chem Allied Limited (12.30%), less than Lykis Limited (9.87%), greater than Kothari Fermentation and Biochem Limited (-4.97%), less than Gayatri BioOrganics Limited (2.25%), greater than Golden Tobacco Limited (-3.65%), greater than Golden Tobacco Limited (-3.65%), less than Unique Organics Limited (22.83%), less than Simbhaoli Sugars Limited (34.44%), less than Simbhaoli Sugars Limited (34.44%),

| Company | ROE | Market cap |

|---|---|---|

| 4.76% | $681.91M | |

| 12.30% | $539.70M | |

| 9.87% | $954.03M | |

| -4.97% | $705.00M | |

| 2.25% | $1.04B | |

| -3.65% | $555.21M | |

| -3.65% | $556.61M | |

| 22.83% | $594.11M | |

| 34.44% | $389.67M | |

| 34.44% | $389.57M |

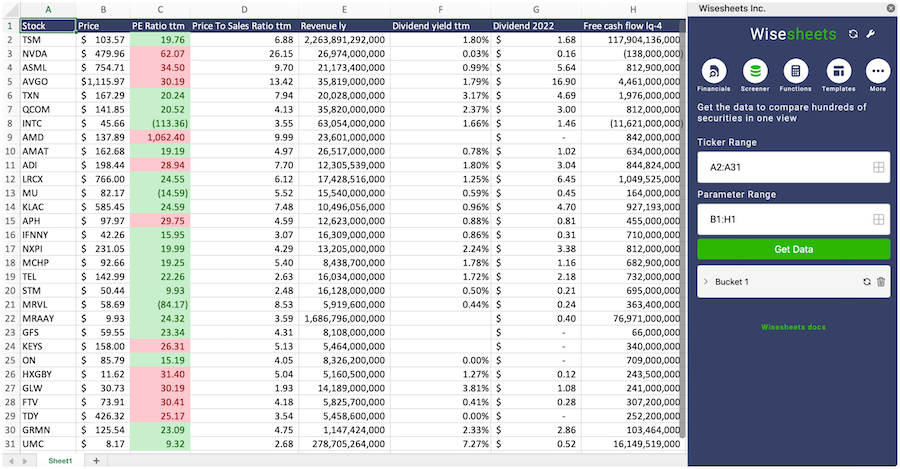

Build a custom stock screener for Anjani Foods Limited (ANJANIFOODS.BO) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Anjani Foods Limited using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

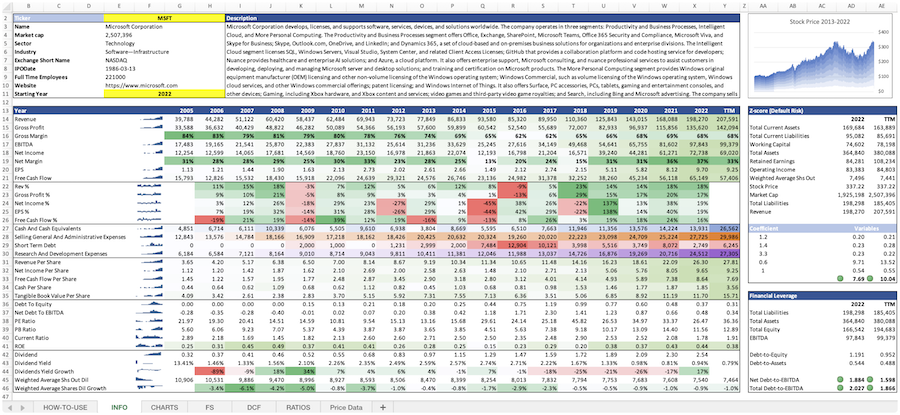

Anjani Foods Limited (ANJANIFOODS.BO) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Anjani Foods Limited or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the ROE?

How can you use the ROE?

What is Anjani Foods Limited's ROE?

How is the ROE calculated for Anjani Foods Limited (ANJANIFOODS.BO)?

What is the highest ROE for Anjani Foods Limited (ANJANIFOODS.BO)?

What is the 3-year average ROE for Anjani Foods Limited (ANJANIFOODS.BO)?

What is the 5-year average ROE for Anjani Foods Limited (ANJANIFOODS.BO)?

How does the current ROE for Anjani Foods Limited (ANJANIFOODS.BO) compare to its historical average?