Nicco Parks & Resorts Limited

NICCOPAR.BO

Price:

$85.57

Market Cap:

$4.00B

Nicco Parks & Resorts Limited primarily operates theme-based amusement parks. The company operates through Park Operations; Consultancy, Contracts and sale of rides Components; and F & B and other recreational facilities segments. It operates various amusement parks and water parks in India and Bangladesh. In addition, the company manufactures and supplies rides for large amusement parks in the United Kingdom, Germany, Dubai, and Japan. Nicco Parks & Resorts Limited was incorporated in 1989 and is based in Kolkata, India.

Industry

Leisure

IPO Date

2002-01-10

Stock Exchange

BSE

Ticker

NICCOPAR.BO

PE Ratio

[75.73]

ROE

[5.02%]

Current Ratio

[3.08]

Dividend Yield

[2.16%]

Enterprise Value

[3.97B]

Dividend History

The PE Ratio as of December 2025 (TTM) for Nicco Parks & Resorts Limited (NICCOPAR.BO) is 75.73

According to Nicco Parks & Resorts Limited’s latest financial reports and current stock price. The company's current PE Ratio is 75.73. This represents a change of -45.50% compared to the average of 138.96 of the last 4 quarters.

Nicco Parks & Resorts Limited (NICCOPAR.BO) Historical PE Ratio (quarterly & annually)

How has NICCOPAR.BO PE Ratio performed in the past?

The mean historical PE Ratio of Nicco Parks & Resorts Limited over the last ten years is 17.57. The current 75.73 PE Ratio has changed 43.00% with respect to the historical average. Over the past ten years (40 quarters), NICCOPAR.BO's PE Ratio was at its highest in in the September 2025 quarter at 526.25. The PE Ratio was at its lowest in in the September 2021 quarter at -159.38.

Average

17.57

Median

23.44

Minimum

-68.50

Maximum

62.42

Nicco Parks & Resorts Limited (NICCOPAR.BO) PE Ratio by Quarter and Year

Discovering the peaks and valleys of Nicco Parks & Resorts Limited PE Ratio, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 75.73%

Maximum Annual PE Ratio = 62.42

Minimum Annual Increase = -420.79%

Minimum Annual PE Ratio = -68.50

| Year | PE Ratio | Change |

|---|---|---|

| 2025 | 24.46 | -15.01% |

| 2024 | 28.78 | 18.98% |

| 2023 | 24.19 | -61.24% |

| 2022 | 62.42 | -191.11% |

| 2021 | -68.50 | -420.79% |

| 2020 | 21.35 | 47.29% |

| 2019 | 14.50 | -36.83% |

| 2018 | 22.95 | 6.12% |

| 2017 | 21.63 | -9.57% |

| 2016 | 23.92 | 75.73% |

Nicco Parks & Resorts Limited (NICCOPAR.BO) Average PE Ratio

How has NICCOPAR.BO PE Ratio performed in the past?

The current PE Ratio of Nicco Parks & Resorts Limited (NICCOPAR.BO) is greater than its 3-year, greater than its 5-year, and greater than its 10-year historical averages

3-year avg

25.81

5-year avg

14.27

10-year avg

17.57

Nicco Parks & Resorts Limited (NICCOPAR.BO) PE Ratio vs. Peers

How is NICCOPAR.BO’s PE Ratio compared to its peers?

Nicco Parks & Resorts Limited’s PE Ratio is greater than Khadim India Limited (60.36), greater than Khadim India Limited (60.36), greater than Sinclairs Hotels Limited (32.25), greater than Sinclairs Hotels Limited (32.25), greater than Nahar Industrial Enterprises Limited (21.48), greater than Kanpur Plastipack Limited (24.87), greater than Kanpur Plastipack Limited (24.87), greater than Spencer's Retail Limited (-1.55), greater than Nandan Denim Limited (10.62), greater than Nandan Denim Limited (10.62),

| Company | PE Ratio | Market cap |

|---|---|---|

| 60.36 | $3.15B | |

| 60.36 | $3.12B | |

| 32.25 | $4.28B | |

| 32.25 | $4.31B | |

| 21.48 | $4.70B | |

| 24.87 | $4.66B | |

| 24.87 | $4.65B | |

| -1.55 | $3.74B | |

| 10.62 | $4.32B | |

| 10.62 | $4.30B |

Build a custom stock screener for Nicco Parks & Resorts Limited (NICCOPAR.BO) and other stocks

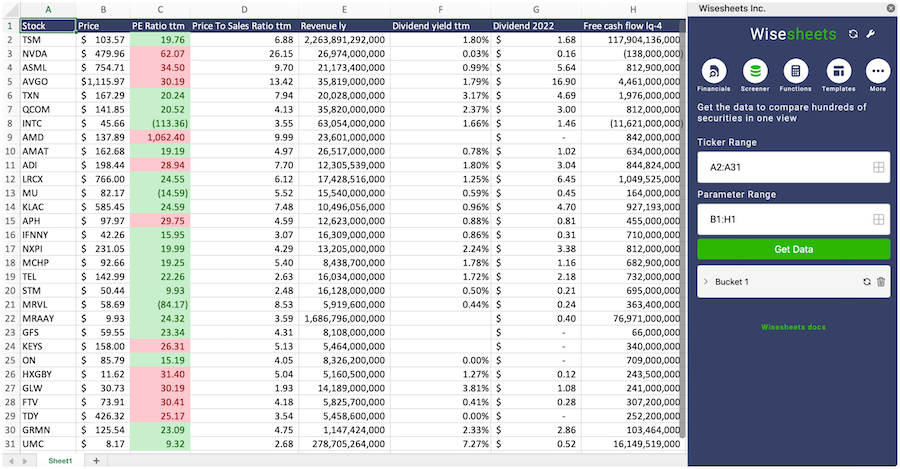

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Nicco Parks & Resorts Limited using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

Nicco Parks & Resorts Limited (NICCOPAR.BO) and other stocks custom spreadsheet templates

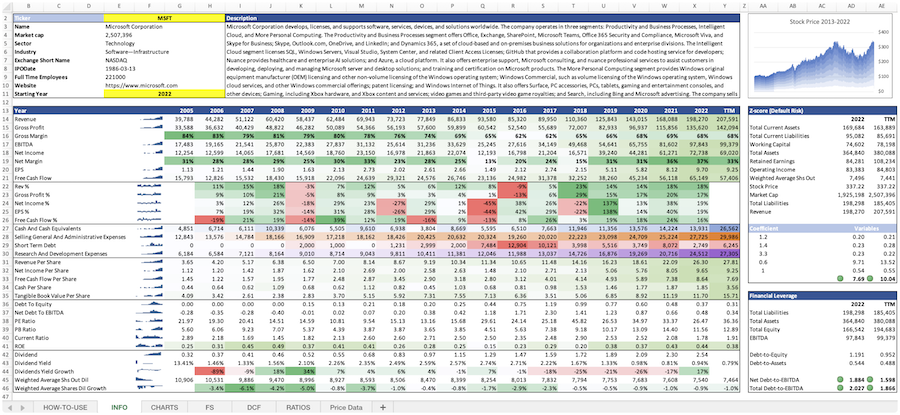

The easiest way to analyze a company like Nicco Parks & Resorts Limited or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the PE Ratio?

How can you use the PE Ratio?

What is Nicco Parks & Resorts Limited's PE Ratio?

How is the PE Ratio calculated for Nicco Parks & Resorts Limited (NICCOPAR.BO)?

What is the highest PE Ratio for Nicco Parks & Resorts Limited (NICCOPAR.BO)?

What is the 3-year average PE Ratio for Nicco Parks & Resorts Limited (NICCOPAR.BO)?

What is the 5-year average PE Ratio for Nicco Parks & Resorts Limited (NICCOPAR.BO)?

How does the current PE Ratio for Nicco Parks & Resorts Limited (NICCOPAR.BO) compare to its historical average?