Public Joint-Stock Company Unipro

UPRO.ME

Price:

$1.478

Market Cap:

$93.19B

Public Joint-Stock Company Unipro engages in the production and sale of electricity, and power and heat energy in Russia. It operates five power plants with a total installed capacity of 11,245 megawatts. The company sells electricity on the wholesale electricity and capacity market; and provides distributed power solutions. It is also involved in engineering activities. The company was formerly known as Open Joint-Stock Company E.ON Russia and changed its name to Public Joint-Stock Company Unipro in June 2016. The company was founded in 2005 and is headquartered in Moscow, Russia. Public Joint-Stock Company Unipro is a subsidiary of Uniper SE.

Industry

Independent Power Producers

IPO Date

2011-11-21

Stock Exchange

MCX

Ticker

UPRO.ME

PE Ratio

[11.37]

ROE

[16.01%]

Current Ratio

[14.67]

Dividend Yield

[0%]

Enterprise Value

[93.19B]

Dividend History

The Enterprise Value as of December 2025 (TTM) for Public Joint-Stock Company Unipro (UPRO.ME) is 93.19B

According to Public Joint-Stock Company Unipro’s latest financial reports and current stock price. The company's current Enterprise Value is 93.19B. This represents a change of -2.18% compared to the average of 95.27B of the last 4 quarters.

Public Joint-Stock Company Unipro (UPRO.ME) Historical Enterprise Value (quarterly & annually)

How has UPRO.ME Enterprise Value performed in the past?

The mean historical Enterprise Value of Public Joint-Stock Company Unipro over the last ten years is 143.57B. The current 93.19B Enterprise Value has changed 6.39% with respect to the historical average. Over the past ten years (40 quarters), UPRO.ME's Enterprise Value was at its highest in in the March 2021 quarter at 195.28B. The Enterprise Value was at its lowest in in the September 2022 quarter at 49.29B.

Average

143.57B

Median

164.91B

Minimum

58.23B

Maximum

191.13B

Public Joint-Stock Company Unipro (UPRO.ME) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of Public Joint-Stock Company Unipro Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 46.29%

Maximum Annual Enterprise Value = 191.13B

Minimum Annual Increase = -65.48%

Minimum Annual Enterprise Value = 58.23B

| Year | Enterprise Value | Change |

|---|---|---|

| 2024 | 89.12B | 17.07% |

| 2023 | 76.12B | 30.73% |

| 2022 | 58.23B | -65.48% |

| 2021 | 168.68B | -4.89% |

| 2020 | 177.35B | 1.15% |

| 2019 | 175.33B | 8.80% |

| 2018 | 161.15B | 3.00% |

| 2017 | 156.45B | -14.11% |

| 2016 | 182.16B | -4.69% |

| 2015 | 191.13B | 46.29% |

Public Joint-Stock Company Unipro (UPRO.ME) Average Enterprise Value

How has UPRO.ME Enterprise Value performed in the past?

The current Enterprise Value of Public Joint-Stock Company Unipro (UPRO.ME) is greater than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

74.49B

5-year avg

113.90B

10-year avg

143.57B

Public Joint-Stock Company Unipro (UPRO.ME) Enterprise Value vs. Peers

How is UPRO.ME’s Enterprise Value compared to its peers?

Public Joint-Stock Company Unipro’s Enterprise Value is less than Public Joint Stock Company Mosenergo (96.11B), greater than Public Joint-Stock Company "Second Generating Company of the Electric Power Wholesale Market" (85.33B), less than Public Joint-Stock Company Federal Grid Company of Unified Energy System (594.71B), less than Public Joint stock company Rosseti Lenenergo (110.96B), greater than Public Joint Stock Company Group of Companies TNS energo (44.17B), greater than Public Joint Stock Company Rosseti Volga (28.02B), greater than Interregional Distribution Grid Company of Urals, Joint Stock Company (58.83B), greater than Public Joint-Stock Energy and Electrification Company Samaraenergo (4.58B), greater than Public Joint Stock Company "ROSSETI Northern Caucasus" (38.91B), greater than Public Joint-Stock Company Territorial Generation Company No.2 (24.88B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 96.11B | $82.38B | |

| 85.33B | $47.18B | |

| 594.71B | $91.93B | |

| 110.96B | $131.05B | |

| 44.17B | $42.85B | |

| 28.02B | $27.23B | |

| 58.83B | $38.89B | |

| 4.58B | $9.87B | |

| 38.91B | $34.25B | |

| 24.88B | $9.39B |

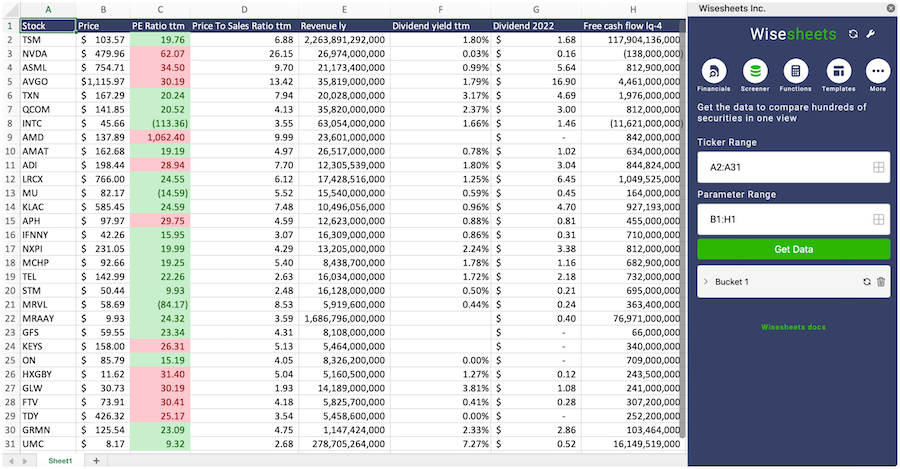

Build a custom stock screener for Public Joint-Stock Company Unipro (UPRO.ME) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Public Joint-Stock Company Unipro using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

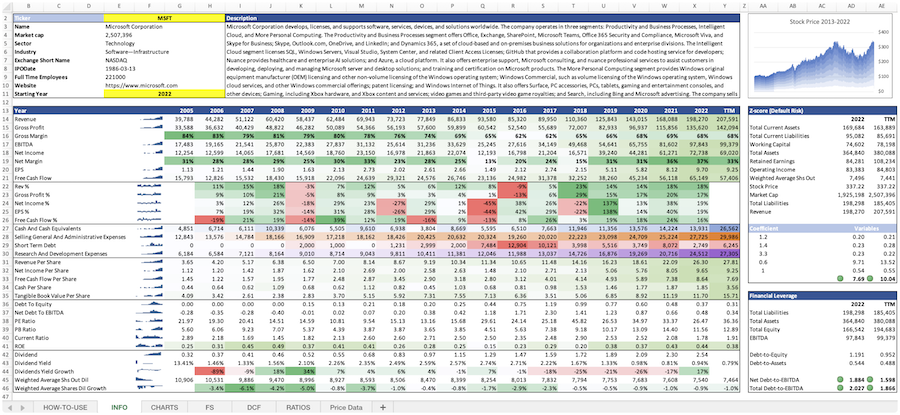

Public Joint-Stock Company Unipro (UPRO.ME) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Public Joint-Stock Company Unipro or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is Public Joint-Stock Company Unipro's Enterprise Value?

What is the highest Enterprise Value for Public Joint-Stock Company Unipro (UPRO.ME)?

What is the 3-year average Enterprise Value for Public Joint-Stock Company Unipro (UPRO.ME)?

What is the 5-year average Enterprise Value for Public Joint-Stock Company Unipro (UPRO.ME)?

How does the current Enterprise Value for Public Joint-Stock Company Unipro (UPRO.ME) compare to its historical average?