TE Connectivity Ltd.

TEL

Price:

$221.77

Market Cap:

$65.10B

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia Pacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions. The Transportation Solutions segment provides terminals and connector systems and components, sensors, relays, antennas, heat shrink tubing, and application tooling products for use in the automotive, commercial transportation, and sensor markets. The Industrial Solutions segment offers terminals and connector systems and components; and heat shrink tubing, interventional medical components,...[Read more]

Industry

Hardware, Equipment & Parts

IPO Date

2007-06-14

Stock Exchange

NYSE

Ticker

TEL

PE Ratio

[31.91]

ROE

[16.50%]

Current Ratio

[1.65]

Dividend Yield

[1.25%]

Enterprise Value

[69.55B]

Dividend History

The Enterprise Value as of January 2026 (TTM) for TE Connectivity Ltd. (TEL) is 69.55B

According to TE Connectivity Ltd.’s latest financial reports and current stock price. The company's current Enterprise Value is 69.55B. This represents a change of 14.98% compared to the average of 60.49B of the last 4 quarters.

TE Connectivity Ltd. (TEL) Historical Enterprise Value (quarterly & annually)

How has TEL Enterprise Value performed in the past?

The mean historical Enterprise Value of TE Connectivity Ltd. over the last ten years is 41.60B. The current 69.55B Enterprise Value has changed 16.62% with respect to the historical average. Over the past ten years (40 quarters), TEL's Enterprise Value was at its highest in in the December 2025 quarter at 72.81B. The Enterprise Value was at its lowest in in the June 2016 quarter at 23.81B.

Average

41.60B

Median

37.59B

Minimum

26.99B

Maximum

69.76B

TE Connectivity Ltd. (TEL) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of TE Connectivity Ltd. Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 43.55%

Maximum Annual Enterprise Value = 69.76B

Minimum Annual Increase = -22.86%

Minimum Annual Enterprise Value = 26.99B

| Year | Enterprise Value | Change |

|---|---|---|

| 2025 | 69.76B | 39.34% |

| 2024 | 50.06B | 18.80% |

| 2023 | 42.14B | 6.67% |

| 2022 | 39.51B | -22.86% |

| 2021 | 51.21B | 43.55% |

| 2020 | 35.67B | 3.30% |

| 2019 | 34.53B | 2.95% |

| 2018 | 33.54B | 2.85% |

| 2017 | 32.61B | 20.85% |

| 2016 | 26.99B | 8.69% |

TE Connectivity Ltd. (TEL) Average Enterprise Value

How has TEL Enterprise Value performed in the past?

The current Enterprise Value of TE Connectivity Ltd. (TEL) is greater than its 3-year, greater than its 5-year, and greater than its 10-year historical averages

3-year avg

53.99B

5-year avg

50.54B

10-year avg

41.60B

TE Connectivity Ltd. (TEL) Enterprise Value vs. Peers

How is TEL’s Enterprise Value compared to its peers?

TE Connectivity Ltd.’s Enterprise Value is greater than Littelfuse, Inc. (7.43B), greater than Fabrinet (17.65B), greater than Jabil Inc. (27.82B), greater than Sanmina Corporation (9.39B), greater than Methode Electronics, Inc. (518.40M), less than Amphenol Corporation (182.93B), greater than Plexus Corp. (4.71B), greater than OSI Systems, Inc. (4.49B), greater than Benchmark Electronics, Inc. (1.82B), greater than Bel Fuse Inc. (2.81B), greater than LSI Industries Inc. (697.37M), greater than Vicor Corporation (7.14B), greater than Flex Ltd. (26.55B), greater than Celestica Inc. (40.33B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 7.43B | $7.83B | |

| 17.65B | $17.95B | |

| 27.82B | $26.02B | |

| 9.39B | $8.34B | |

| 518.40M | $281.50M | |

| 182.93B | $178.66B | |

| 4.71B | $4.84B | |

| 4.49B | $4.61B | |

| 1.82B | $1.79B | |

| 2.81B | $2.67B | |

| 697.37M | $669.43M | |

| 7.14B | $7.50B | |

| 26.55B | $24.51B | |

| 40.33B | $39.71B |

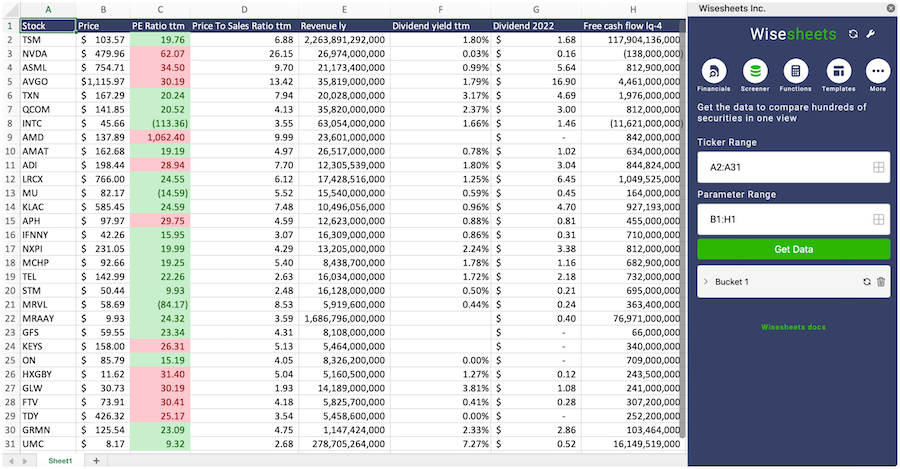

Build a custom stock screener for TE Connectivity Ltd. (TEL) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like TE Connectivity Ltd. using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

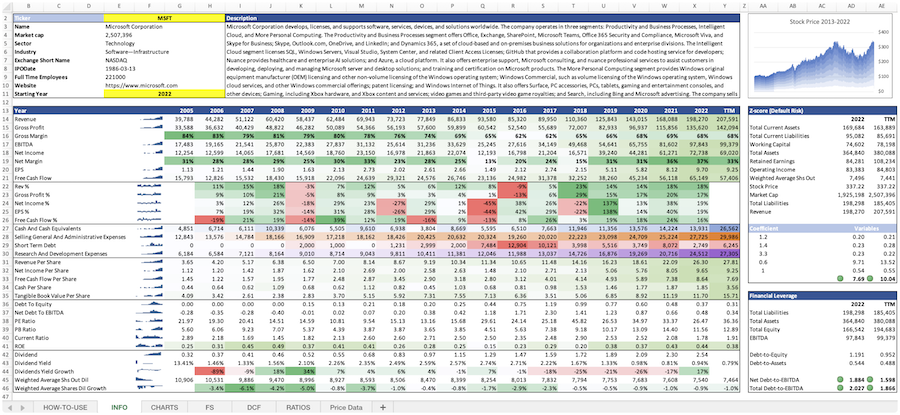

TE Connectivity Ltd. (TEL) and other stocks custom spreadsheet templates

The easiest way to analyze a company like TE Connectivity Ltd. or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is TE Connectivity Ltd.'s Enterprise Value?

What is the highest Enterprise Value for TE Connectivity Ltd. (TEL)?

What is the 3-year average Enterprise Value for TE Connectivity Ltd. (TEL)?

What is the 5-year average Enterprise Value for TE Connectivity Ltd. (TEL)?

How does the current Enterprise Value for TE Connectivity Ltd. (TEL) compare to its historical average?