Phol Dhanya Public Company Limited

PHOL.BK

Price:

$2.72

Market Cap:

$550.80M

Phol Dhanya Public Company Limited distributes occupational safety, health, and environment products in Thailand and internationally. It offers personal protective equipment, including helmets, safety eye glasses, ear plugs, dust and chemical protection masks, safety gloves, shoes, firefighting cloths, and other protective equipment; and safety and environment products, such as toxic gas and flammable gas detectors, emergency eye, body washing, and chemical ventilation equipment; storing, transporting, and transferring equipment; ventilators, safety locks, and safety sign products. The company also provides control environment products comprising clean room clothing, as well as equipment for...[Read more]

Industry

Security & Protection Services

IPO Date

2010-12-09

Stock Exchange

SET

Ticker

PHOL.BK

PE Ratio

[8.50]

ROE

[16.20%]

Current Ratio

[2.67]

Dividend Yield

[8.46%]

Enterprise Value

[568.30M]

Dividend History

The Enterprise Value as of December 2025 (TTM) for Phol Dhanya Public Company Limited (PHOL.BK) is 568.30M

According to Phol Dhanya Public Company Limited’s latest financial reports and current stock price. The company's current Enterprise Value is 568.30M. This represents a change of -5.99% compared to the average of 604.49M of the last 4 quarters.

Phol Dhanya Public Company Limited (PHOL.BK) Historical Enterprise Value (quarterly & annually)

How has PHOL.BK Enterprise Value performed in the past?

The mean historical Enterprise Value of Phol Dhanya Public Company Limited over the last ten years is 635.91M. The current 568.30M Enterprise Value has changed 8.84% with respect to the historical average. Over the past ten years (40 quarters), PHOL.BK's Enterprise Value was at its highest in in the December 2016 quarter at 1.03B. The Enterprise Value was at its lowest in in the March 2020 quarter at 276.60M.

Average

635.91M

Median

618.73M

Minimum

357.00M

Maximum

988.17M

Phol Dhanya Public Company Limited (PHOL.BK) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of Phol Dhanya Public Company Limited Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 61.83%

Maximum Annual Enterprise Value = 988.17M

Minimum Annual Increase = -35.90%

Minimum Annual Enterprise Value = 357.00M

| Year | Enterprise Value | Change |

|---|---|---|

| 2024 | 626.85M | 8.13% |

| 2023 | 579.73M | -12.15% |

| 2022 | 659.95M | -21.75% |

| 2021 | 843.35M | 52.22% |

| 2020 | 554.04M | 55.19% |

| 2019 | 357.00M | -19.79% |

| 2018 | 445.06M | -35.90% |

| 2017 | 694.28M | -29.74% |

| 2016 | 988.17M | 61.83% |

| 2015 | 610.61M | 4.71% |

Phol Dhanya Public Company Limited (PHOL.BK) Average Enterprise Value

How has PHOL.BK Enterprise Value performed in the past?

The current Enterprise Value of Phol Dhanya Public Company Limited (PHOL.BK) is less than than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

622.18M

5-year avg

652.79M

10-year avg

635.91M

Phol Dhanya Public Company Limited (PHOL.BK) Enterprise Value vs. Peers

How is PHOL.BK’s Enterprise Value compared to its peers?

Phol Dhanya Public Company Limited’s Enterprise Value is less than Kumwell Corporation Public Company Limited (584.34M), greater than Utility Business Alliance Public Company Limited (116.18M), less than Porn Prom Metal Public Company Limited (1.07B), less than TRC Construction Public Company Limited (1.69B), greater than CAZ (Thailand) Public Company Limited (428.75M), greater than Teka Construction Public Company Limited (449.09M), less than ATP 30 Public Company Limited (1.11B), greater than Salee Printing Public Company Limited (444.47M), less than Mena Transport Public Company Limited (818.00M), less than Lighting and Equipment Public Company Limited (1.75B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 584.34M | $447.20M | |

| 116.18M | $534.00M | |

| 1.07B | $502.18M | |

| 1.69B | $656.93M | |

| 428.75M | $514.50M | |

| 449.09M | $519.00M | |

| 1.11B | $573.14M | |

| 444.47M | $432.00M | |

| 818.00M | $565.18M | |

| 1.75B | $521.56M |

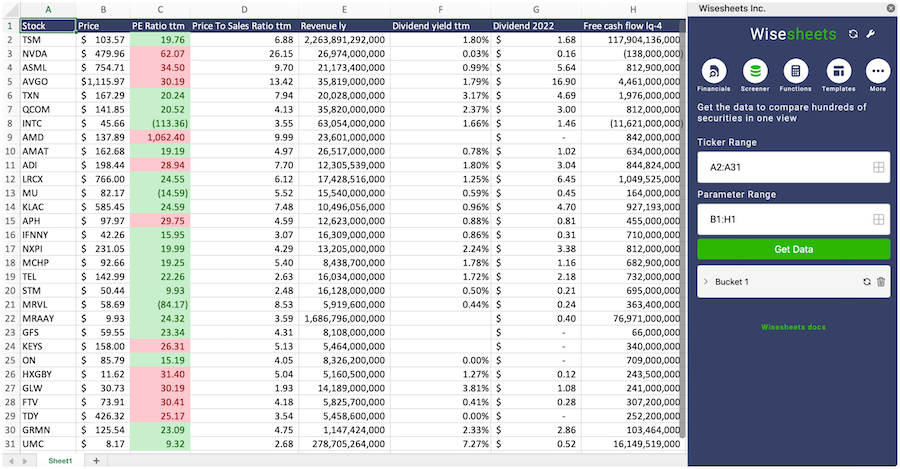

Build a custom stock screener for Phol Dhanya Public Company Limited (PHOL.BK) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Phol Dhanya Public Company Limited using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

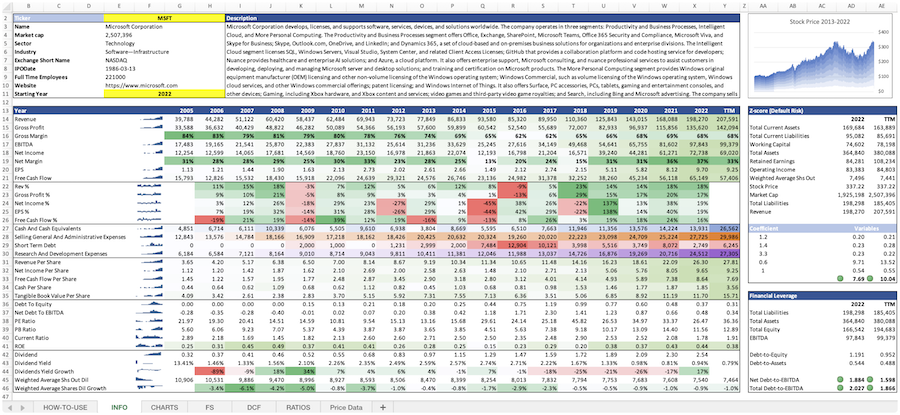

Phol Dhanya Public Company Limited (PHOL.BK) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Phol Dhanya Public Company Limited or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is Phol Dhanya Public Company Limited's Enterprise Value?

What is the highest Enterprise Value for Phol Dhanya Public Company Limited (PHOL.BK)?

What is the 3-year average Enterprise Value for Phol Dhanya Public Company Limited (PHOL.BK)?

What is the 5-year average Enterprise Value for Phol Dhanya Public Company Limited (PHOL.BK)?

How does the current Enterprise Value for Phol Dhanya Public Company Limited (PHOL.BK) compare to its historical average?