Gelion plc

GELNF

Price:

$0.28

Market Cap:

$33.71M

Gelion plc engages in the research and development, design, manufacture, and sale of battery systems in the United Kingdom and internationally. The company offers zinc-bromide batteries under the Endure name. Its products are used in various applications, which include off grid, commercial and industrial, industrial light towers, grid services, and solar and wind applications. The company was incorporated in 2015 and is based in London, united Kingdom.

Industry

Electrical Equipment & Parts

IPO Date

2021-12-07

Stock Exchange

OTC

Ticker

GELNF

PE Ratio

[-3.26]

ROE

[-60.14%]

Current Ratio

[4.32]

Dividend Yield

[0%]

Enterprise Value

[31.07M]

Dividend History

The Enterprise Value as of January 2026 (TTM) for Gelion plc (GELNF) is 31.07M

According to Gelion plc’s latest financial reports and current stock price. The company's current Enterprise Value is 31.07M. This represents a change of 20.18% compared to the average of 25.86M of the last 4 quarters.

Gelion plc (GELNF) Historical Enterprise Value (quarterly & annually)

How has GELNF Enterprise Value performed in the past?

The mean historical Enterprise Value of Gelion plc over the last ten years is 76.62M. The current 31.07M Enterprise Value has changed 3.96% with respect to the historical average. Over the past ten years (40 quarters), GELNF's Enterprise Value was at its highest in in the December 2021 quarter at 111.60M. The Enterprise Value was at its lowest in in the June 2021 quarter at -21693003.00.

Average

76.62M

Median

55.45M

Minimum

-2050800.00

Maximum

159.31M

Gelion plc (GELNF) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of Gelion plc Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 37.61%

Maximum Annual Enterprise Value = 159.31M

Minimum Annual Increase = -7829.43%

Minimum Annual Enterprise Value = -2050800.00

| Year | Enterprise Value | Change |

|---|---|---|

| 2025 | 32.60M | 37.61% |

| 2024 | 23.69M | 10.88% |

| 2023 | 21.36M | -72.72% |

| 2022 | 78.31M | -44.54% |

| 2021 | 141.20M | -11.37% |

| 2020 | 159.31M | 0.50% |

| 2019 | 158.52M | -7829.43% |

Gelion plc (GELNF) Average Enterprise Value

How has GELNF Enterprise Value performed in the past?

The current Enterprise Value of Gelion plc (GELNF) is greater than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

25.88M

5-year avg

59.43M

10-year avg

76.62M

Gelion plc (GELNF) Enterprise Value vs. Peers

How is GELNF’s Enterprise Value compared to its peers?

Gelion plc’s Enterprise Value is less than Chen Hsong Holdings Limited (335.75M), less than AJIS Co., Ltd. (14.35B), less than Aduro Clean Technologies Inc. (586.45M), less than CB Industrial Product Holding Berhad (262.59M), less than JG Summit Holdings, Inc. (378.05B), less than OptiCept Technologies AB (publ) (168.61M), less than Ceres Global Ag Corp. (211.85M), greater than Pendrell Corporation (-71082000.00), less than Q-Free ASA (1.54B), less than Parker Corporation (22.43B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 335.75M | $145.59M | |

| 14.35B | $130.82M | |

| 586.45M | $148.38M | |

| 262.59M | $141.26M | |

| 378.05B | $142.33M | |

| 168.61M | $139.69M | |

| 211.85M | $138.94M | |

| -71082000.00 | $113.40M | |

| 1.54B | $140.17M | |

| 22.43B | $112.15M |

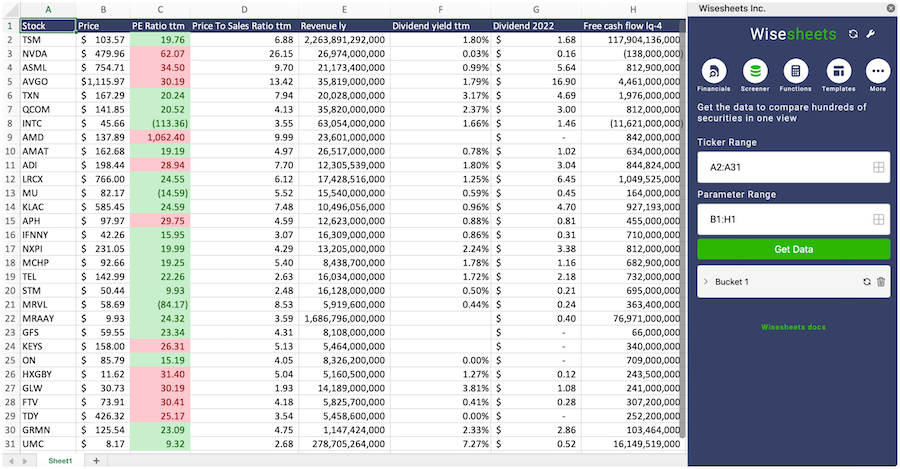

Build a custom stock screener for Gelion plc (GELNF) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Gelion plc using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

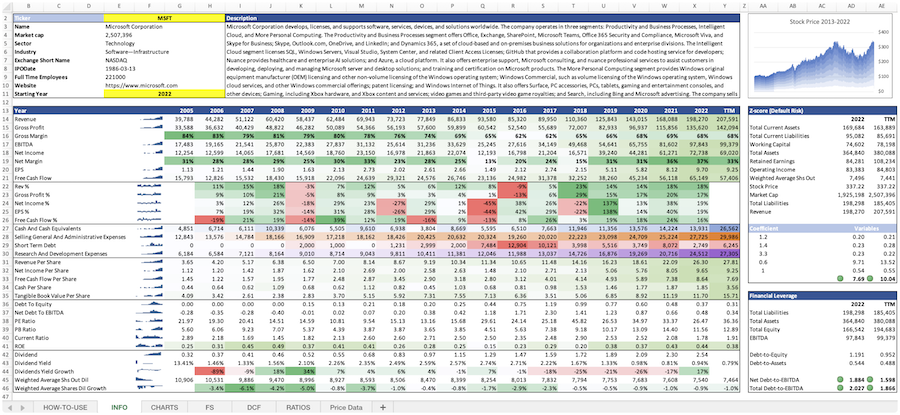

Gelion plc (GELNF) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Gelion plc or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is Gelion plc's Enterprise Value?

What is the highest Enterprise Value for Gelion plc (GELNF)?

What is the 3-year average Enterprise Value for Gelion plc (GELNF)?

What is the 5-year average Enterprise Value for Gelion plc (GELNF)?

How does the current Enterprise Value for Gelion plc (GELNF) compare to its historical average?