Thong Guan Industries Berhad

7034.KL

Price:

$1.19

Market Cap:

$475.96M

Thong Guan Industries Berhad, an investment holding company, manufactures and trades in plastic products and packaged food, beverages, and other consumable products. The company operates through Plastic Products; and Food, Beverages and Other Consumable Products segments. Its products include stretch and maxstretch films; bottom seal poly bags, garbage bags, bags and sheets perforated on roll, punch and pin hole, pallet shrouds, non-entrapment seal, apron, stretch hood, side seal, produce roll, header block, carry and shopping bags, laminated barrier films, form-fill seal sheet, and collation shrink films for industrial and commercial use; tinted food wraps; and additives, such as calcium ca...[Read more]

Industry

Packaging & Containers

IPO Date

2000-01-03

Stock Exchange

KLS

Ticker

7034.KL

PE Ratio

[8.50]

ROE

[6.06%]

Current Ratio

[2.65]

Dividend Yield

[5.88%]

Enterprise Value

[349.27M]

Dividend History

The Enterprise Value as of December 2025 (TTM) for Thong Guan Industries Berhad (7034.KL) is 349.27M

According to Thong Guan Industries Berhad’s latest financial reports and current stock price. The company's current Enterprise Value is 349.27M. This represents a change of -9.10% compared to the average of 384.24M of the last 4 quarters.

Thong Guan Industries Berhad (7034.KL) Historical Enterprise Value (quarterly & annually)

How has 7034.KL Enterprise Value performed in the past?

The mean historical Enterprise Value of Thong Guan Industries Berhad over the last ten years is 566.08M. The current 349.27M Enterprise Value has changed 6.07% with respect to the historical average. Over the past ten years (40 quarters), 7034.KL's Enterprise Value was at its highest in in the September 2022 quarter at 1.02B. The Enterprise Value was at its lowest in in the December 2018 quarter at 258.28M.

Average

566.08M

Median

475.99M

Minimum

280.16M

Maximum

960.82M

Thong Guan Industries Berhad (7034.KL) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of Thong Guan Industries Berhad Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 78.51%

Maximum Annual Enterprise Value = 960.82M

Minimum Annual Increase = -26.96%

Minimum Annual Enterprise Value = 280.16M

| Year | Enterprise Value | Change |

|---|---|---|

| 2024 | 498.43M | -23.90% |

| 2023 | 655.00M | -24.25% |

| 2022 | 864.68M | -10.01% |

| 2021 | 960.82M | 18.67% |

| 2020 | 809.64M | 78.51% |

| 2019 | 453.55M | 37.89% |

| 2018 | 328.91M | -26.96% |

| 2017 | 450.33M | 25.35% |

| 2016 | 359.25M | 28.23% |

| 2015 | 280.16M | 38.66% |

Thong Guan Industries Berhad (7034.KL) Average Enterprise Value

How has 7034.KL Enterprise Value performed in the past?

The current Enterprise Value of Thong Guan Industries Berhad (7034.KL) is less than than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

672.70M

5-year avg

757.71M

10-year avg

566.08M

Thong Guan Industries Berhad (7034.KL) Enterprise Value vs. Peers

How is 7034.KL’s Enterprise Value compared to its peers?

Thong Guan Industries Berhad’s Enterprise Value is less than Berjaya Food Bhd (1.02B), less than Panasonic Manufacturing Malaysia Berhad (431.52M), less than Mynews Holdings Bhd (630.13M), greater than RGB International Bhd. (287.41M), greater than Yoong Onn Corporation Berhad (219.92M), less than Wellcall Holdings Berhad (593.23M), less than Parkson Holdings Berhad (3.18B), less than Bermaz Auto Berhad (968.81M), greater than Feytech Holdings Berhad (169.33M), less than Signature International Berhad (1.06B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 1.02B | $442.95M | |

| 431.52M | $431.30M | |

| 630.13M | $420.20M | |

| 287.41M | $338.99M | |

| 219.92M | $250.61M | |

| 593.23M | $637.37M | |

| 3.18B | $229.78M | |

| 968.81M | $812.74M | |

| 169.33M | $278.26M | |

| 1.06B | $903.70M |

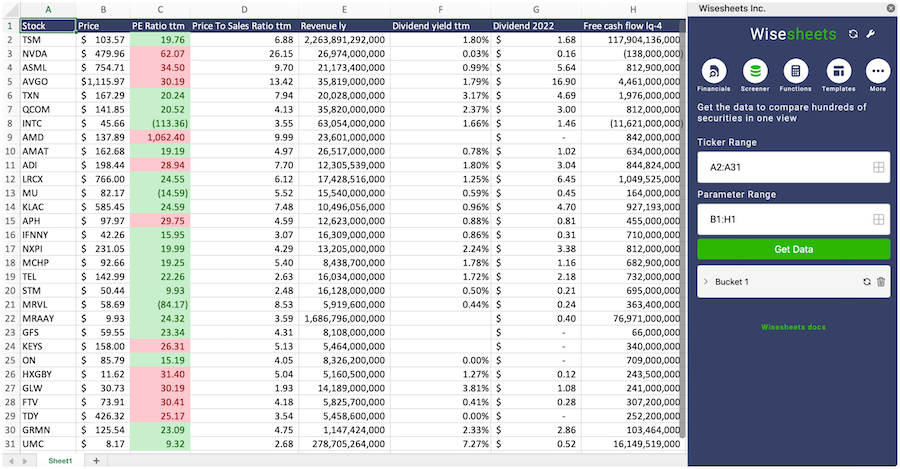

Build a custom stock screener for Thong Guan Industries Berhad (7034.KL) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Thong Guan Industries Berhad using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

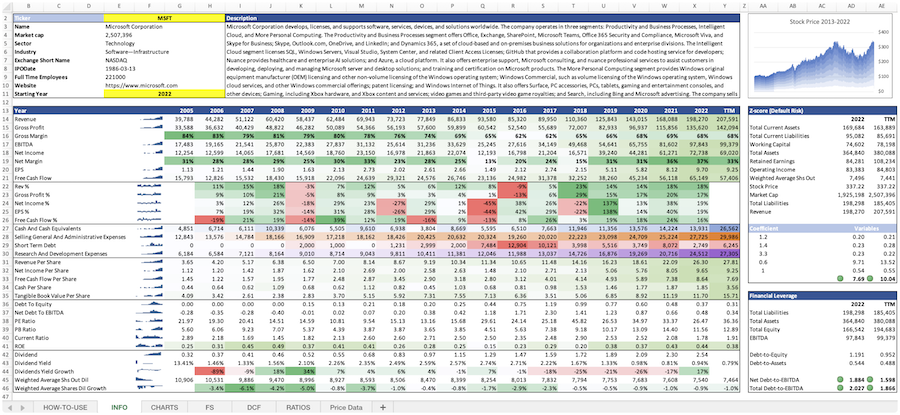

Thong Guan Industries Berhad (7034.KL) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Thong Guan Industries Berhad or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is Thong Guan Industries Berhad's Enterprise Value?

What is the highest Enterprise Value for Thong Guan Industries Berhad (7034.KL)?

What is the 3-year average Enterprise Value for Thong Guan Industries Berhad (7034.KL)?

What is the 5-year average Enterprise Value for Thong Guan Industries Berhad (7034.KL)?

How does the current Enterprise Value for Thong Guan Industries Berhad (7034.KL) compare to its historical average?