China Medical System Holdings Limited

0867.HK

Price:

$13.31

Market Cap:

$29.14B

China Medical System Holdings Limited, an investment holding company, manufactures, sells, markets, and promotes pharmaceutical products in the People's Republic of China. The company's products include Plendil for the treatment of hypertension and stable angina pectoris; XinHuoSu for the treatment of acute heart failure; Deanxit for the treating mild-to-moderate depression, anxiety, and psychosomatic affections; Ursofalk for the treatment of cholesterol gallstones in the gallbladder, cholestatic liver disease, and biliary reflux gastritis; Salofalk for treating Ulcerative Colitis and Crohn's disease; Bioflor for the treatment of diarrhea; Combizym for dyspepsia; Augentropfen Stulln Mono eye...[Read more]

Industry

Drug Manufacturers - Specialty & Generic

IPO Date

2010-09-28

Stock Exchange

HKSE

Ticker

0867.HK

PE Ratio

[17.75]

ROE

[9.90%]

Current Ratio

[5.78]

Dividend Yield

[2.24%]

Enterprise Value

[26.43B]

Dividend History

The Enterprise Value as of December 2025 (TTM) for China Medical System Holdings Limited (0867.HK) is 26.43B

According to China Medical System Holdings Limited’s latest financial reports and current stock price. The company's current Enterprise Value is 26.43B. This represents a change of 36.43% compared to the average of 19.37B of the last 4 quarters.

China Medical System Holdings Limited (0867.HK) Historical Enterprise Value (quarterly & annually)

How has 0867.HK Enterprise Value performed in the past?

The mean historical Enterprise Value of China Medical System Holdings Limited over the last ten years is 23.78B. The current 26.43B Enterprise Value has changed 11.01% with respect to the historical average. Over the past ten years (40 quarters), 0867.HK's Enterprise Value was at its highest in in the June 2021 quarter at 39.80B. The Enterprise Value was at its lowest in in the June 2006 quarter at 0.

Average

23.78B

Median

24.13B

Minimum

14.37B

Maximum

38.97B

China Medical System Holdings Limited (0867.HK) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of China Medical System Holdings Limited Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 53.65%

Maximum Annual Enterprise Value = 38.97B

Minimum Annual Increase = -57.57%

Minimum Annual Enterprise Value = 14.37B

| Year | Enterprise Value | Change |

|---|---|---|

| 2024 | 14.37B | -47.37% |

| 2023 | 27.30B | 13.52% |

| 2022 | 24.04B | -1.83% |

| 2021 | 24.49B | 53.65% |

| 2020 | 15.94B | -34.16% |

| 2019 | 24.21B | 46.42% |

| 2018 | 16.53B | -57.57% |

| 2017 | 38.97B | 36.89% |

| 2016 | 28.47B | 20.97% |

| 2015 | 23.53B | -5.18% |

China Medical System Holdings Limited (0867.HK) Average Enterprise Value

How has 0867.HK Enterprise Value performed in the past?

The current Enterprise Value of China Medical System Holdings Limited (0867.HK) is greater than its 3-year, greater than its 5-year, and greater than its 10-year historical averages

3-year avg

21.90B

5-year avg

21.23B

10-year avg

23.78B

China Medical System Holdings Limited (0867.HK) Enterprise Value vs. Peers

How is 0867.HK’s Enterprise Value compared to its peers?

China Medical System Holdings Limited’s Enterprise Value is greater than Livzon Pharmaceutical Group Inc. (25.75B), less than Grand Pharmaceutical Group Limited (32.92B), less than China Resources Pharmaceutical Group Limited (100.56B), less than Xuanzhubio-b (38.15B), greater than The United Laboratories International Holdings Limited (18.16B), less than Simcere Pharmaceutical Group Limited (27.46B), greater than Asymchem Laboratories (Tianjin) Co., Ltd. (24.43B), greater than Shenzhen Hepalink Pharmaceutical Group Co., Ltd. (15.88B), less than Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (48.90B), greater than HUTCHMED (China) Limited (1.05B),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 25.75B | $31.90B | |

| 32.92B | $28.78B | |

| 100.56B | $28.96B | |

| 38.15B | $38.32B | |

| 18.16B | $24.35B | |

| 27.46B | $31.92B | |

| 24.43B | $27.52B | |

| 15.88B | $16.81B | |

| 48.90B | $47.49B | |

| 1.05B | $18.07B |

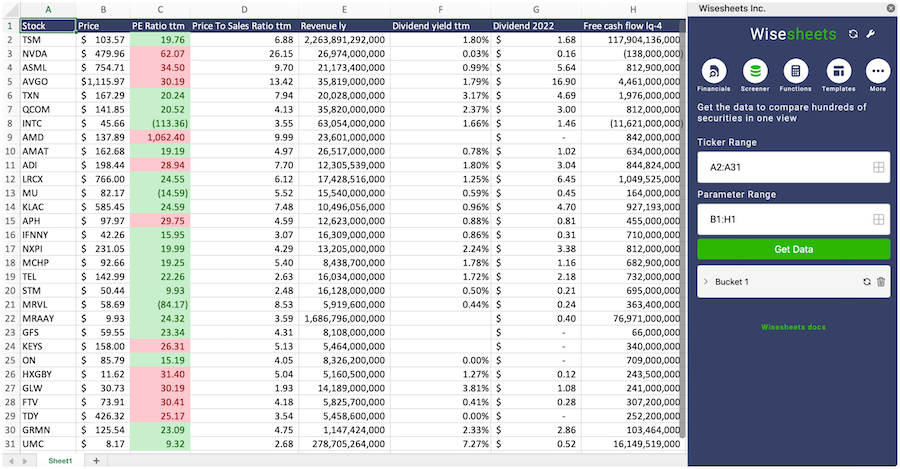

Build a custom stock screener for China Medical System Holdings Limited (0867.HK) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like China Medical System Holdings Limited using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

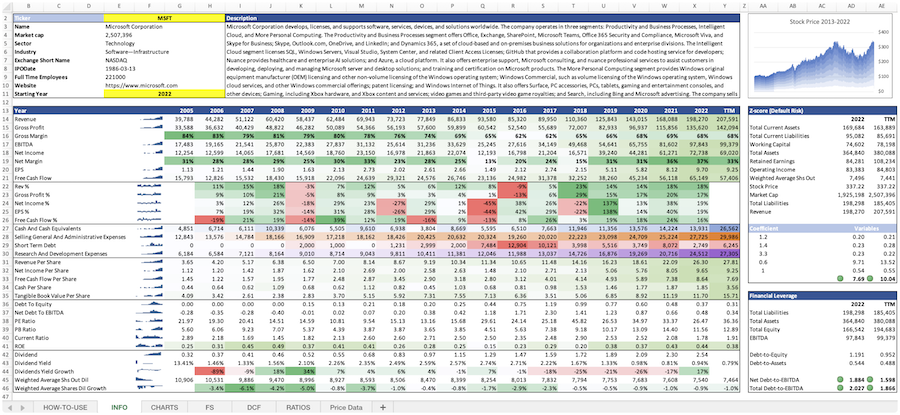

China Medical System Holdings Limited (0867.HK) and other stocks custom spreadsheet templates

The easiest way to analyze a company like China Medical System Holdings Limited or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is China Medical System Holdings Limited's Enterprise Value?

What is the highest Enterprise Value for China Medical System Holdings Limited (0867.HK)?

What is the 3-year average Enterprise Value for China Medical System Holdings Limited (0867.HK)?

What is the 5-year average Enterprise Value for China Medical System Holdings Limited (0867.HK)?

How does the current Enterprise Value for China Medical System Holdings Limited (0867.HK) compare to its historical average?