Octopus AIM VCT 2 plc

OSEC.L

Octopus AIM VCT 2 plc is a venture capital trust specializing in investments in AIM quoted companies. It seeks to invest in various sectors such as financial services, healthcare equipment, food producers, business services, pharmaceuticals and biotechnology, travel and leisure, industrial engineering, oil equipment, support services, general retailers, software, and media. The fund typically makes investments in the United Kingdom region. It typically makes investments between $23.27 million and $465.38 million.

Industry

Asset Management

IPO Date

2006-01-25

Stock Exchange

LSE

Ticker

OSEC.L

PE Ratio

[-8.55]

ROE

[-9.05%]

Current Ratio

[4.76]

Dividend Yield

[9.18%]

Enterprise Value

[70.22M]

Dividend History

The Dividend Yield as of December 2025 (TTM) for Octopus AIM VCT 2 plc (OSEC.L) is 9.18%

According to Octopus AIM VCT 2 plc’s latest financial reports and current stock price. The company's current Dividend Yield is 9.18%. This represents a change of 17.15% compared to the average of 7.83% of the last 4 quarters.

Octopus AIM VCT 2 plc (OSEC.L) Historical Dividend Yield (quarterly & annually)

How has OSEC.L Dividend Yield performed in the past?

The mean historical Dividend Yield of Octopus AIM VCT 2 plc over the last ten years is 7.15%. The current 9.18% Dividend Yield has changed 28.41% with respect to the historical average. Over the past ten years (40 quarters), OSEC.L's Dividend Yield was at its highest in in the November 2024 quarter at 14.60%. The Dividend Yield was at its lowest in in the June 2006 quarter at 0.34%.

Average

7.15%

Median

6.45%

Minimum

4.44%

Maximum

15.43%

Octopus AIM VCT 2 plc (OSEC.L) Dividend Yield by Quarter and Year

Discovering the peaks and valleys of Octopus AIM VCT 2 plc Dividend Yield, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 114.34%

Maximum Annual Dividend Yield = 15.43%

Minimum Annual Increase = -51.60%

Minimum Annual Dividend Yield = 4.44%

| Year | Dividend Yield | Change |

|---|---|---|

| 2024 | 15.43% | 114.34% |

| 2023 | 7.20% | -0.21% |

| 2022 | 7.22% | 26.73% |

| 2021 | 5.69% | 27.79% |

| 2020 | 4.46% | -51.60% |

| 2019 | 9.21% | 85.07% |

| 2018 | 4.97% | 11.95% |

| 2017 | 4.44% | -18.34% |

| 2016 | 5.44% | -26.41% |

| 2015 | 7.39% | 34.27% |

Octopus AIM VCT 2 plc (OSEC.L) Average Dividend Yield

How has OSEC.L Dividend Yield performed in the past?

The current Dividend Yield of Octopus AIM VCT 2 plc (OSEC.L) is less than than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

9.95%

5-year avg

8.00%

10-year avg

7.15%

Octopus AIM VCT 2 plc (OSEC.L) Dividend Yield vs. Peers

How is OSEC.L’s Dividend Yield compared to its peers?

Octopus AIM VCT 2 plc’s Dividend Yield is greater than Baker Steel Resources Trust Ltd. (0%), less than Merchants Trust (The) PLC (6.86%), less than Maven Income and Growth VCT 4 PLC (8.74%), greater than MIGO Opportunities Trust plc (0%), less than Value and Indexed Property Income Trust Plc (6.66%), less than New Star Investment Trust plc (2.89%), less than Schroders Capital Global Innov Trust Ord (0%), less than Vanguard FTSE Global All Cap Index Fund GBP Inc (1.34%), less than Vanguard FTSE Global All Cap Index Fund GBP Acc (0%), less than US Solar Fund Plc (7.29%),

| Company | Dividend Yield | Market cap |

|---|---|---|

| 0% | N/A | |

| 6.86% | N/A | |

| 8.74% | N/A | |

| 0% | N/A | |

| 6.66% | N/A | |

| 2.89% | N/A | |

| 0% | N/A | |

| 1.34% | N/A | |

| 0% | N/A | |

| 7.29% | N/A |

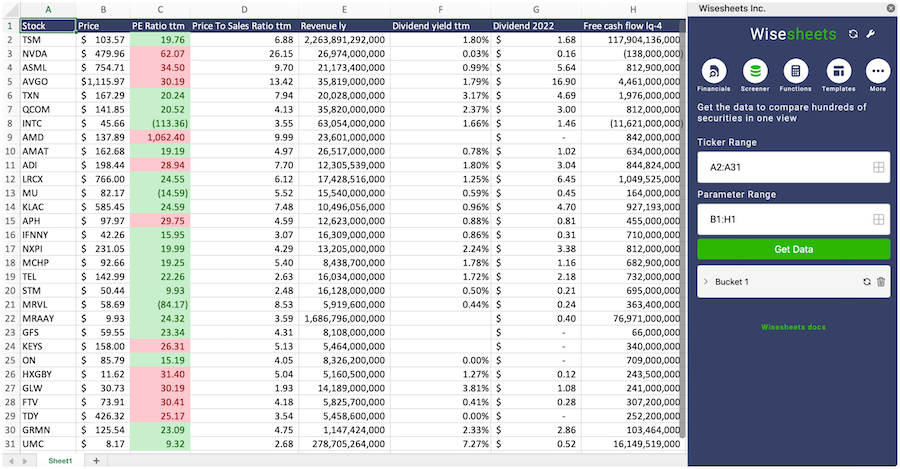

Build a custom stock screener for Octopus AIM VCT 2 plc (OSEC.L) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like Octopus AIM VCT 2 plc using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

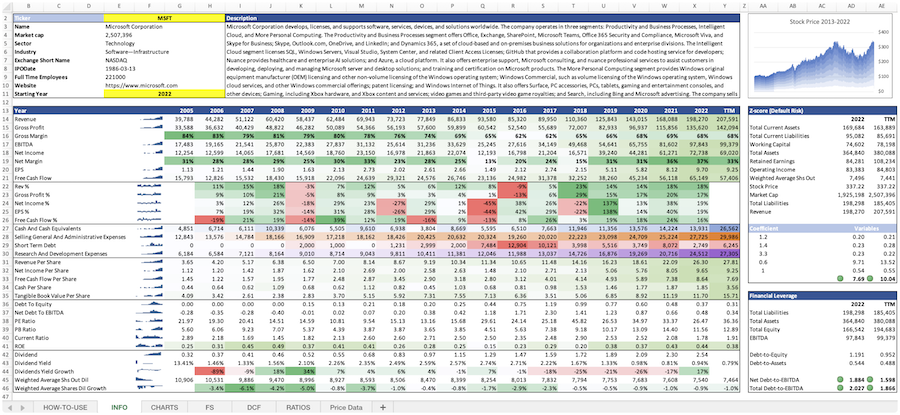

Octopus AIM VCT 2 plc (OSEC.L) and other stocks custom spreadsheet templates

The easiest way to analyze a company like Octopus AIM VCT 2 plc or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Dividend Yield?

How can you use the Dividend Yield?

What is Octopus AIM VCT 2 plc's Dividend Yield?

How is the Dividend Yield calculated for Octopus AIM VCT 2 plc (OSEC.L)?

What is the highest Dividend Yield for Octopus AIM VCT 2 plc (OSEC.L)?

What is the 3-year average Dividend Yield for Octopus AIM VCT 2 plc (OSEC.L)?

What is the 5-year average Dividend Yield for Octopus AIM VCT 2 plc (OSEC.L)?

How does the current Dividend Yield for Octopus AIM VCT 2 plc (OSEC.L) compare to its historical average?