The Taiwan Fund, Inc.

TWN

Price:

$58.28

Market Cap:

$355.73M

The Taiwan Fund, Inc. is a closed-ended equity mutual fund launched and managed by JF International Management Inc. It invests in the public equity markets of Taiwan. The fund seeks to invest in stocks of companies operating across diversified sectors. It employs fundamental analysis focusing on such factors as overall growth prospects, competitive position in the respective industry, technology, research, and development, productivity, labor costs, raw material costs and sources, profit margins, return on investment, capital resources, government regulation, and management to create its portfolio. The fund benchmarks the performance of its portfolio against the TAIEX Total Return Index. The...[Read more]

Industry

Asset Management

IPO Date

1986-12-16

Stock Exchange

NYSE

Ticker

TWN

The Enterprise Value as of January 2026 (TTM) for The Taiwan Fund, Inc. (TWN) is 337.31M

According to The Taiwan Fund, Inc.’s latest financial reports and current stock price. The company's current Enterprise Value is 337.31M. This represents a change of 31.84% compared to the average of 255.84M of the last 4 quarters.

The Taiwan Fund, Inc. (TWN) Historical Enterprise Value (quarterly & annually)

How has TWN Enterprise Value performed in the past?

The mean historical Enterprise Value of The Taiwan Fund, Inc. over the last ten years is 198.66M. The current 337.31M Enterprise Value has changed 16.88% with respect to the historical average. Over the past ten years (40 quarters), TWN's Enterprise Value was at its highest in in the August 2025 quarter at 288.29M. The Enterprise Value was at its lowest in in the August 2012 quarter at -4263349.00.

Average

198.66M

Median

181.86M

Minimum

136.63M

Maximum

288.29M

The Taiwan Fund, Inc. (TWN) Enterprise Value by Quarter and Year

Discovering the peaks and valleys of The Taiwan Fund, Inc. Enterprise Value, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 43.43%

Maximum Annual Enterprise Value = 288.29M

Minimum Annual Increase = -25.37%

Minimum Annual Enterprise Value = 136.63M

| Year | Enterprise Value | Change |

|---|---|---|

| 2025 | 288.29M | 5.21% |

| 2024 | 274.02M | 36.62% |

| 2023 | 200.58M | 6.67% |

| 2022 | 188.04M | -25.37% |

| 2021 | 251.96M | 43.43% |

| 2020 | 175.67M | 28.57% |

| 2019 | 136.63M | -14.21% |

| 2018 | 159.26M | -8.83% |

| 2017 | 174.70M | 27.08% |

| 2016 | 137.47M | 18.70% |

The Taiwan Fund, Inc. (TWN) Average Enterprise Value

How has TWN Enterprise Value performed in the past?

The current Enterprise Value of The Taiwan Fund, Inc. (TWN) is greater than its 3-year, greater than its 5-year, and greater than its 10-year historical averages

3-year avg

254.30M

5-year avg

240.58M

10-year avg

198.66M

The Taiwan Fund, Inc. (TWN) Enterprise Value vs. Peers

How is TWN’s Enterprise Value compared to its peers?

The Taiwan Fund, Inc.’s Enterprise Value is less than Cohen & Steers Closed-End Opportunity Fund, Inc. (416.33M), greater than Liberty All-Star Growth Fund, Inc. (328.85M), greater than Harbor Mid Cap Value Fund (0), greater than Baron International Growth Fund (0), greater than Columbia Select Small Cap Value Fund (0), less than Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. (434.02M), less than abrdn U.S. Small Cap Equity Fund (0), greater than Templeton Dragon Fund, Inc. (309.16M),

| Company | Enterprise Value | Market cap |

|---|---|---|

| 416.33M | $416.33M | |

| 328.85M | $327.14M | |

| 0 | $384.77M | |

| 0 | $325.72M | |

| 0 | $365.41M | |

| 434.02M | $379.65M | |

| 0 | $348.71M | |

| 309.16M | $306.55M |

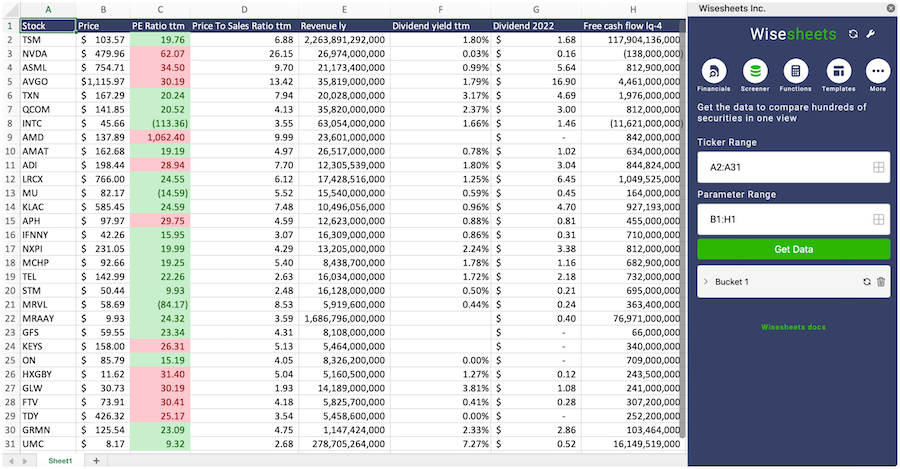

Build a custom stock screener for The Taiwan Fund, Inc. (TWN) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like The Taiwan Fund, Inc. using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

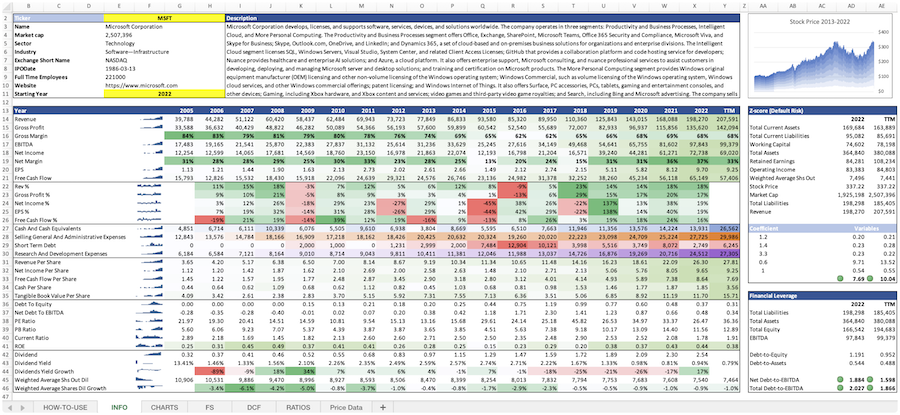

The Taiwan Fund, Inc. (TWN) and other stocks custom spreadsheet templates

The easiest way to analyze a company like The Taiwan Fund, Inc. or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Enterprise Value?

How can you use the Enterprise Value?

What is The Taiwan Fund, Inc.'s Enterprise Value?

What is the highest Enterprise Value for The Taiwan Fund, Inc. (TWN)?

What is the 3-year average Enterprise Value for The Taiwan Fund, Inc. (TWN)?

What is the 5-year average Enterprise Value for The Taiwan Fund, Inc. (TWN)?

How does the current Enterprise Value for The Taiwan Fund, Inc. (TWN) compare to its historical average?