Introduction: The Market's Scoreboard

Have you ever heard someone say, “the S&P 500 is up today” and thought, “Okay, but what does that mean?” Market indices are like grades on a test. They don’t show every detail, but they give you a quick snapshot of how the overall market is doing. By the end of this lesson, you’ll understand:

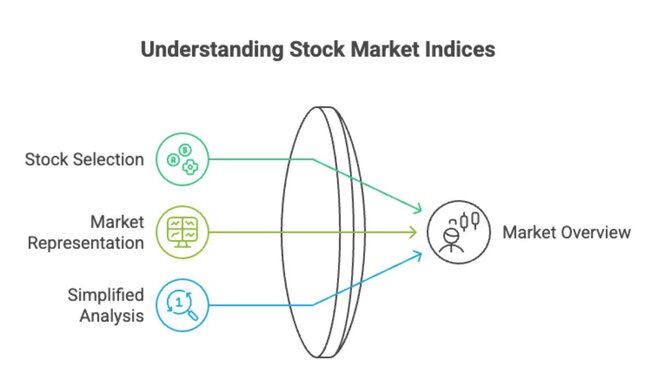

What Is a Stock Market Index?

A stock market index is a collection of selected stocks representing a segment of the market. It’s like watching the final score instead of every play in a game: you get the result without all the details.

The Importance of Benchmarks

Benchmarks help you ask the right questions: If your portfolio returned 6% and the S&P 500 returned 10%, you now know how you stacked up. Investors aim to “beat the market” - meaning they want their portfolio to outperform its benchmark.

Meet the Big Three Indexes

S&P 500 500 of the largest U.S. companies. It’s the most widely used benchmark. Dow Jones Industrial Average 30 large, established (“blue-chip”) U.S. companies. It’s historic, but limited in scope. Nasdaq Composite Tech-heavy and growth-oriented, with companies like Apple, Amazon, and Tesla.

Index Funds and ETFs: Invest in the Index

You don’t have to pick individual stocks to invest in an index.

You can buy:

- Index funds or

- Exchange-Traded Funds (ETFs)

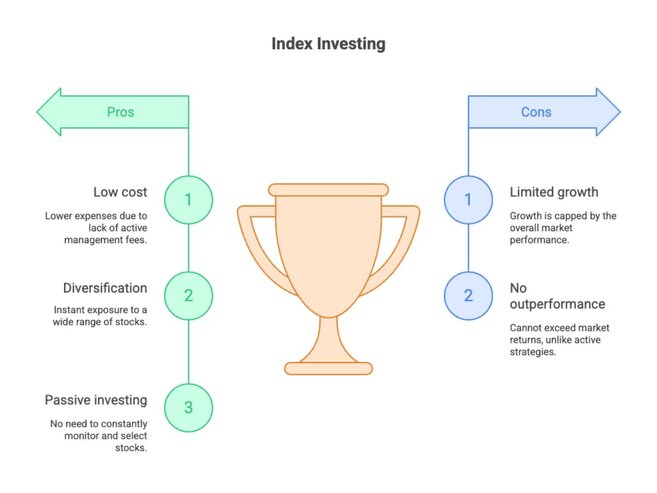

Benefits:

- Low cost: they follow the market without fancy managers

- Instant diversification: own many stocks at once

- Passive investing: you don’t have to actively pick winners

Quiz

What does a stock market index measure?

a) The performance of a group of stocks

b) The overall economy

c) Individual company earnings

Which index contains more companies?

a) Dow Jones

b) S&P 500

c) Nasdaq Composite

See the answers at the bottom

Summary and Key Takeaways

- Indices are like market scoreboards - they tell you how broad groups of stocks are doing.

- Benchmarks help you evaluate your performance, and see where you stand.

- You can invest in entire indexes via low-cost index funds or ETFs for easy diversification.

1) What does a stock market index measure?Answers to the Quiz and Exercise Questions

Answer: a) The performance of a group of stocks

2) Which index contains more companies?

Answer: c) Nasdaq Composite

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.