Introduction

Emma and Jack earn the same, live in the same city, and drink the same overpriced coffee.

Emma starts investing at 22—just a few hundred bucks a month. Jack waits until 32 and doubles her contributions.

Who retires with more?

Emma. By a mile.

Jack worked harder. Emma just started earlier. That’s the magic of compounding—it rewards those who show up first, not the smartest or hardest-working.

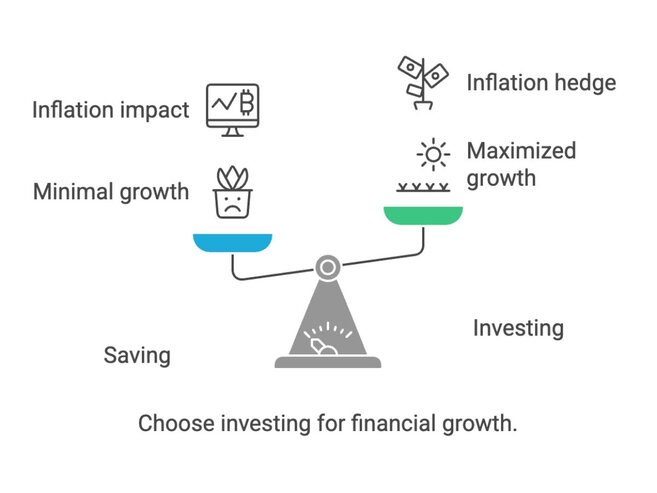

Why Investing Beats Saving

Saving feels responsible, but here’s the problem:

Inflation never takes a day off.

A savings account just coasts while prices climb. Investing, on the other hand, flips the switch—your money starts working for you.

Saving is like keeping a seed in a drawer. Investing is planting it, watering it, and letting it grow.

And the sooner you plant it, the bigger it gets.

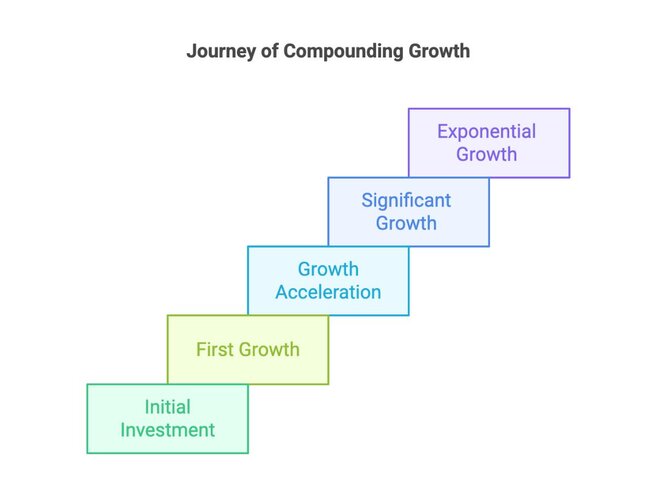

What is Compounding?

Compounding is earning money on your money… then earning money on that money… and so on.

Imagine rolling a small snowball down a hill. It picks up more snow, and the bigger it gets, the faster it grows.

Money works the same way.

Example:

Invest $100 at 5% interest.

Year 1: $105

Year 2: $110.25

Year 3: $115.76

Now scale that up. Invest $10,000 instead of $100 and give it 40 years instead of 30—now you're talking real money.

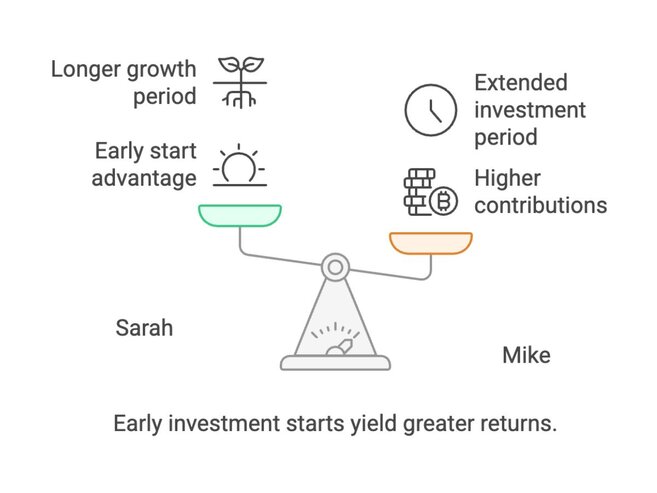

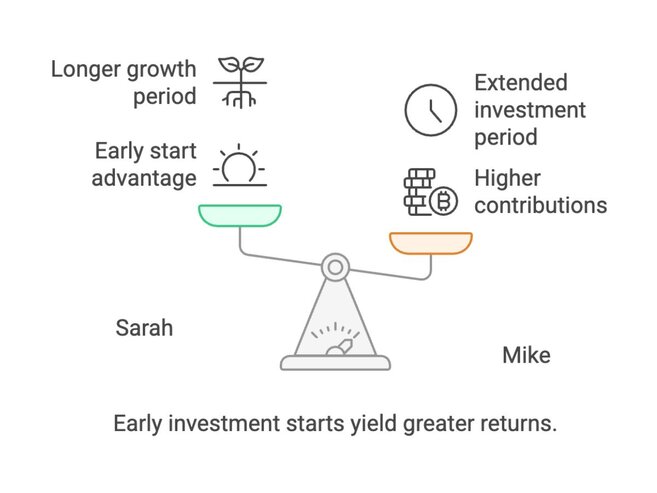

Why Starting Early is Crucial

Sarah invests $200/month at 22, stops after 10 years, and never adds another dollar.

Mike waits until 32, invests $400/month, and keeps going until retirement.

Who ends up with more?

Sarah. Even though she stopped contributing, her money had a head start.

Compounding cares more about when you start than how much you contribute.

Even Warren Buffett—90% of his net worth came after his 50th birthday.

Investing vs Saving: 30-Year Test

| Year | Bank Account | Investment |

|---|---|---|

10 | $11,046 | $21,589 |

20 | $12,202 | $46,610 |

30 | $13,478 | $100,627 |

Same $10,000. The difference? Investing lets compounding work for you.

Every year you wait is a year your snowball isn’t rolling down the hill.

Meanwhile, that little savings account is just trudging along, barely breaking a sweat.

And the punchline is:

The longer you wait to start investing, the harder it is to catch up.

Every year you sit on the sidelines is a year your snowball could’ve been rolling down the hill.

Common Mistakes and Misconceptions

1) "I’ll start later" → Later is expensive. The earlier you start, the less you need to invest.

2) Pulling money out too soon → Compounding needs time. Let it grow.

3) Chasing high returns → Consistency beats trying to hit home runs.

4) Ignoring fees → A 1% fee can quietly siphon away tens of thousands of dollars over time.

Assignment

If you invest $1,000 at 7% for 20 years, what do you end up with?

a) $1,500

b) $2,874

c) $3,870

If you invest $1,000 at 7% for 20 years, what do you end up with?

a) Someone who starts early with less money?

b) Someone who starts later with more money?

See the answers at the bottom

The Cost of Waiting

- Compounding is your money making more money, over and over again.

- Time is your secret weapon. The earlier you start, the less effort it takes.

- Investing beats saving for long-term goals.

- Start small, but start now.

At the end of the day, the biggest financial mistake isn’t picking the wrong stock or enduring a bad year.

It’s waiting.

So stop waiting.

Plant the seed. Let it grow.

Summary and Key Takeaways

- Compounding is your money making more money, over and over again.

- Time is your secret weapon. The earlier you start, the less effort it takes.

- Investing beats saving for long-term goals.

- Start small, but start now.

Answers to the Quiz Questions

1) If you invest $1,000 at 7% for 20 years, what do you end up with?

Answer: c) $3,870

That’s the power of compounding. Your $1,000 nearly quadruples just by sitting there and growing steadily for two decades.

2) Who ends up with more money:

Answer: The person who starts early with less money.

Time is the secret weapon. Even smaller contributions can grow larger than big contributions made later because compounding needs time to work its magic.

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.