Introduction

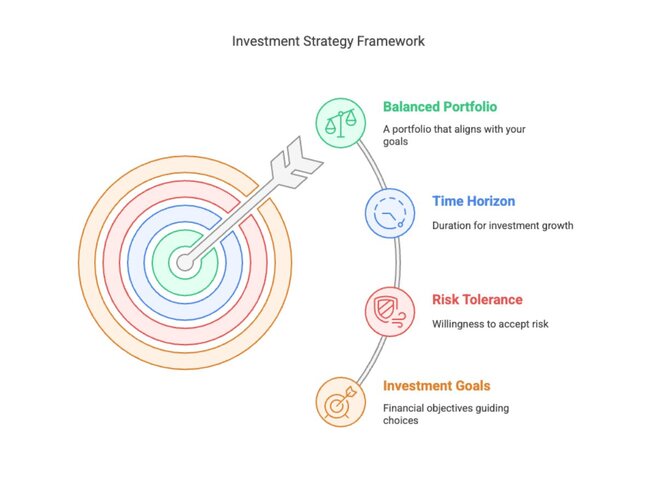

Imagine you just inherited $10K... Do you buy stocks? Bonds? Real estate? Crypto? Every investor faces this question. The right answer? It depends on your goals, risk tolerance, and time horizon. By the end of this, you’ll know: Let’s break it down.

5 Core Investment Types (a.k.a. Asset Classes)

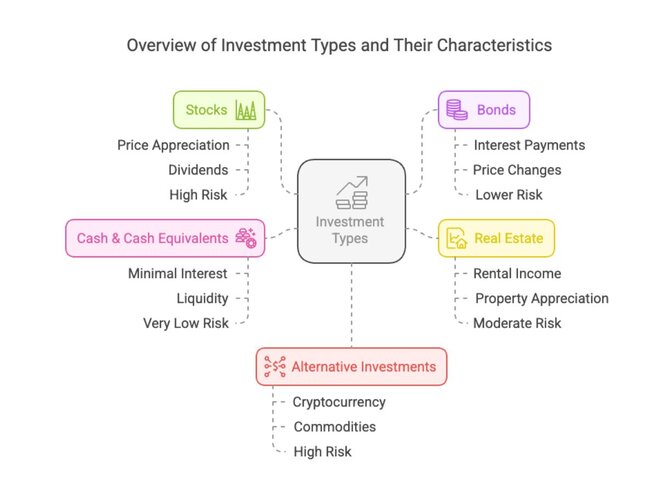

1) Stocks (Equities): Ownership in a Company When you buy stocks, you are essentially buying a piece of a company. How Stocks Make You Money: Price appreciation: If the company grows, so does your stock value. Dividends: Some companies share their profits with investors. Risk Level: High (but great for long-term wealth) Best For: Building long-term wealth over decades. Example: If you had invested $1,000 in Apple stock in 2000, it would be worth over $400,000 today. Stocks outperform most investments over the long run - but they can be volatile in the short term. 2) Bonds (Fixed Income): Loans to Governments & Corporations Buying a bond is like lending money to a company or government. In return, they promise to pay you interest at a fixed rate. How Bonds Make You Money: Risk Level: Lower than stocks, but returns are also lower. Best For: Stability, income, and diversification. Example: Government bonds (like U.S. Treasury bonds) are considered one of the safest investments - but they don’t grow wealth as fast as stocks. 3) Real Estate: Investing in Physical Property Real estate is not just about owning a home… It is also one of the oldest ways to build wealth. How Real Estate Makes You Money: Risk Level: Moderate (can be stable, but requires capital and management). Best For: Generating passive income and long-term growth. Example: Buying a rental property can create steady monthly income, but it also comes with responsibilities like maintenance and tenant management. 4) Cash & Cash Equivalents: Safety & Liquidity Cash is the safest asset, but it comes with a hidden risk: Inflation. How Cash Makes You Money: Risk Level: Very low, but inflation erodes value over time. Best For: Emergency funds and short-term savings. Example: A savings account might feel “safe,” but if inflation is 3% and your bank pays you 1% interest, you’re losing money in real terms. 5) Alternative Investments: Crypto, Commodities, & More Alternative investments don’t fit into the traditional stock/bond/cash categories, since they have their own unique risks and rewards. Types Include: Risk Level: Varies widely - can be high-risk, high-reward. Best For: Diversification and investors with high-risk tolerance. Example: Bitcoin gained over 1,000% in five years, but also lost half its value in a single year. Alternative assets can be exciting, but they aren’t for the faint of heart.

How Different Investments Fit Different Goals & Risk Profiles

Not all investments serve the same purpose. Your financial goals and risk tolerance determine which investments are right for you. Here’s how different assets align with four common investment objectives: 1) Building Long-Term Wealth Best options: Stock and real-estate. Why? These investments offer higher returns over time, driven by compounding growth. Example: Who this is for: 2) Generating Passive Income Best options: Bonds, dividend stocks, rental properties. Why? These provide regular cash flow with lower risk than growth-focused investments. Example: Who this is for: 3) Short-Term Safety & Liquidity Best options: Cash, money market accounts, short-term bonds. Why? These assets offer stability, liquidity, and minimal risk - but lower returns. Example: Who this is for: 4) Diversification & Hedging Against Inflation Best options: Commodities (gold, oil), real estate, alternative investments. Why? These assets often hold value or rise when inflation is high. Example: Who this is for:

Imagine rolling a small snowball down a hill. It picks up more snow, and the bigger it gets, the faster it grows.

Money works the same way.

Example:

Invest $100 at 5% interest.

Year 1: $105

Year 2: $110.25

Year 3: $115.76

Now scale that up. Invest $10,000 instead of $100 and give it 40 years instead of 30—now you're talking real money.

Common Mistakes and Misconceptions

Even with the right knowledge, it’s easy to slip up. Here are the biggest mistakes new investors make: 1) Putting All Your Money in One Asset → One bad move can sink your whole portfolio. Fix: Diversify. Spread your investments across stocks, bonds, real estate, and more. 2) Chasing Trends & Hype → Buying the "next big thing" (hello, crypto in 2021) without understanding it. Fix: Invest in what you understand. Stick to your strategy, not social media FOMO. 3) Avoiding Risk Entirely → Playing it too safe (all cash or low-yield bonds) might feel good short-term—but you’ll lose to inflation. Fix: Take on smart risk based on your timeline and goals. 4) Trying to Time the Market → Buying high, selling low—it's what most people accidentally do. Fix: Invest consistently, regardless of market ups and downs. Time in the market > timing the market. 5) Ignoring Fees → That 1% fee on a fund? It compounds over time and can eat tens of thousands of dollars. Fix: Look for low-cost index funds and ETFs. Keep your investing costs low. 6) Not Rebalancing Your Portfolio → What starts balanced can drift over time and throw off your risk levels. Fix: Review and rebalance once a year to stay on track. 7) Investing Without a Goal → Investing without knowing why leads to bad decisions. Fix: Define your goals (retirement, income, buying a home), then choose investments that support them.

Quiz

Which asset class is best for long-term growth?

a) Bonds

b) Stocks

c) Cash

What type of investment provides regular interest payments?

a) Stocks

a) Real Estate

a) Bonds

See the answers at the bottom

Exercise: Build Your Own Investment Strategy

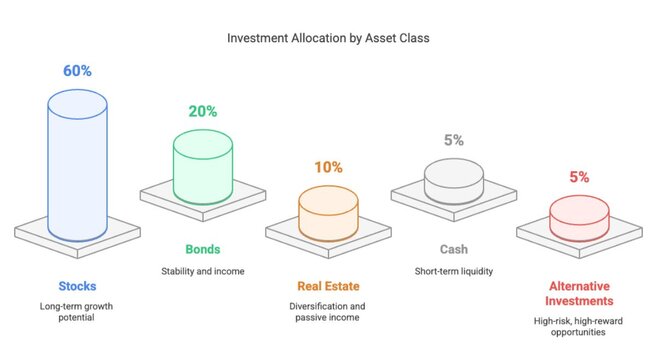

Imagine you have $50,000 to invest. Based on what you’ve learned about different asset classes, how would you allocate it? Consider your: - Goals (Are you focused on growth, income, or safety?) - Risk tolerance (Are you comfortable with volatility, or do you prefer stability?) - Time horizon (Do you need access to this money soon, or is it for the long term?) 💡 Example Allocation for a Balanced Investor: Your allocation might look totally different depending on your financial goals and risk tolerance. Take a minute to think about it - what’s your ideal mix?

Summary and Key Takeaways

Different investments do different jobs. Pick your mix based on your goals: Don’t put all your eggs in one basket. A mix of investments helps protect you if one doesn’t do well. That’s called diversification—and it’s your best defense against risk.

Answers to the Quiz Questions

1) Which asset class is best for long-term growth? Answer: b) Stocks

Stocks historically provide the highest long-term returns, which makes them the best option for building wealth over decades.

2) What type of investment provides regular interest payments? Answer: c) Bonds Bonds pay fixed interest over time, which makes them a popular choice for steady income and stability.

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.