Introduction: The Importance of Goals

Imagine getting into a car and just driving - without a map or a destination. That’s how a lot of people invest. They buy a few stocks, maybe follow a hot tip, maybe panic-sell when things dip. But they don’t really know why they’re investing (or what they’re hoping to achieve). Well, you cannot build a smart investment strategy without knowing what you’re aiming for. Goals give your money direction. They help you choose the right investments, take the right amount of risk, and stay calm when the market gets noisy. In this lesson, we’ll walk through: By the end, you’ll have a clearer picture of where you want to go, and what kind of investment vehicle is right to get you there.

Short-Term vs. Long-Term Goals

All investment goals aren’t created equal. Some are for soon, some are for someday - and mixing them up is how people get burned. Here’s the basic split: Why? Because the timeline is short, you don’t have time to ride out market swings. Long-Term Goals (5+ years) These have more time to recover from market dips (and benefit from long-term growth). Pro tip: Match your investment to your timeline. Don’t put your house down payment in volatile stocks if you need the money in a year.Short-Term Goals (1–3 years)

How to Define Measurable Goals

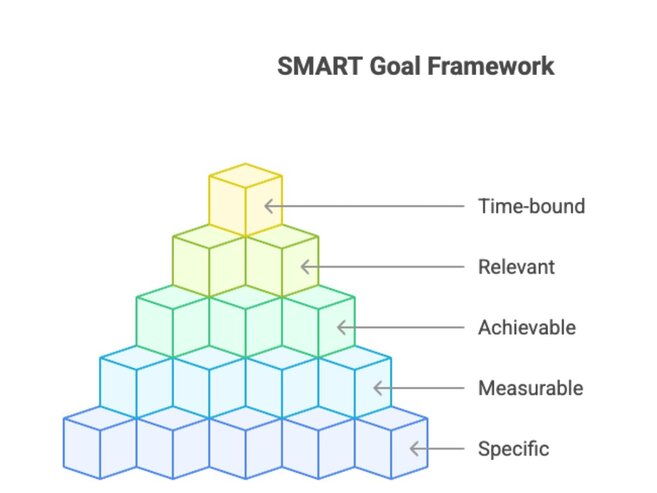

It’s not enough to say, “I want to save for the future.” That’s like saying, “I want to go somewhere nice.” Vague goals lead to vague results. To make real progress, you need clear and measurable targets. Here’s how: Use the SMART Goal Framework:

Example:

“I want to save $25,000 for a house down payment in 3 years.”

That’s a strong goal. Now you can reverse-engineer your plan:

$25,000 / 36 months ≈ $695 per month (plus investment growth, if applicable).

Once your goals are measurable, investing gets a lot more focused (and significantly less stressful).

Quiz

Which is a short-term goal?

a) Retirement

b) Buying a car next year

c) Starting a business in 15 years

Which investment is better for a long-term goal like retirement?

a) Stocks or index funds

b) Cash savings

c) Short-term bonds

See the answers at the bottom

Exercise

Think of one financial goal you have right now. Now write it as a SMART goal.

Example:

“I want to save $10,000 for a solo trip to Japan in 18 months.”

Then ask yourself:

- How much do I need to save each month?

- Where should I park that money based on the timeline?

Summary and Key Takeaways

- Every investment plan starts with a goal.

- Match the goal to the time horizon. The shorter the goal, the safer your strategy needs to be.

- Make your goals SMART. Specific, Measurable, Achievable, Relevant, and Time-bound.

- Break it down. Knowing how much you need to invest each month gives you clarity and confidence.

Clear goals are like a GPS for your financial journey. They keep you on track, and stop you from making emotional decisions when the market gets bumpy.

1) Which is a short-term goal? Answers to the Quiz and Exercise Questions

Quiz Answers:

Answer: b) Buying a car next year

2) Which investment is better for a long-term goal like retirement?

Answer: a) Stocks or index funds Exercise Answers: -

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.