Introduction: The Importance of Financial Statements

Imagine trying to buy a business without knowing how much money it makes, how much debt it has, or whether it’s even profitable. Sounds risky at best, doesn’t it? That’s why financial statements are your best friend when analyzing stocks. They show you exactly how a company makes money, what it owns, what it owes, and how cash moves in and out. In this lesson, you’ll get a clear understanding of the three major financial statements: Plus, you’ll see how they’re all connected, and how to read them like an investor.

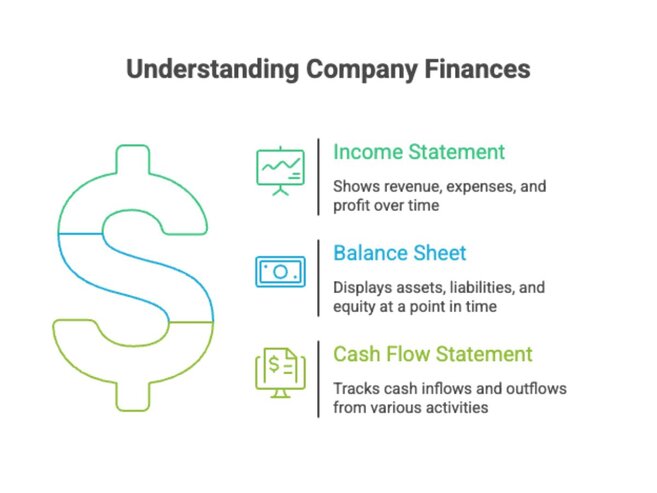

The Big Three Financial Statements

To understand a company, you need to understand these three documents. Each one tells a different part of the story. Income Statement (a.k.a. Profit & Loss Statement) What it shows: Key terms: Think of it as a report card for business performance. Balance Sheet What it shows: Key terms: Snapshot of financial health, like a picture of the company’s finances. Cash Flow Statement What it shows: Key sections: This tells you if the company is actually generating cash, or just showing ‘paper profits’.

How the Financial Statements Are Connected

These three reports are part of a bigger financial story. This is how they link together: Income Statement leads to Net Income At the bottom of the income statement is net income (a.k.a. profit). Balance Sheet is connected to the Cash Flow Statement The cash balance at the end of the cash flow statement shows up on the balance sheet’s assets section as “cash and cash equivalents.” And when a company borrows money (financing activity), that shows up: Why This is Important

Real-World Analogy: A Company is Like a Person

To make financial statements easier to grasp, imagine a company as a person managing their own money. Income Statement = Paycheck vs. Bills It shows what the person earns, what they spend, and how much is left over each month. Balance Sheet = Net Worth Snapshot It’s like a personal balance sheet that shows: Cash Flow Statement = Bank Activity Even if someone “earns” a lot, it doesn’t mean they always have cash. The cash flow statement shows: All three together give you the full story: Are they living within their means? Are they building wealth? Or just scraping by despite a good salary? Same with companies. The numbers only make sense when you connect the dots.

Quiz

Which financial statement shows if a company is actually generating cash?

a) Income Statement

b) Balance Sheet

c) Cash Flow Statement

What does the balance sheet show?

a) A company’s profits over time

b) A snapshot of assets, liabilities, and equity

c) How much the company spent on ads last month

See the answers at the bottom

Exercise: Match the Statement to the Metric

Match each item below to the correct financial statement:

- Net Income → ________

- Total Assets → ________

- Cash from Operations → ________

See the answers at the bottom

Summary and Key Takeaways

- Financial statements tell the story behind the stock. They show how a business earns, spends, and manages money.

- There are three key statements:

- The income statement shows profits

- The balance sheet shows what a company owns and owes

- The cash flow statement shows how money moves in and out

- They’re all connected. Understanding one helps you read the others better.

- Smart investors don’t rely on headlines; they read the numbers. This is how you find strong and healthy companies.

If investing is like buying a business, these statements are how you do your due diligence.

Answers to the Quiz and Exercise Questions

Quiz Answers:

1) Which financial statement shows if a company is actually generating cash?

Answer: c) Cash Flow Statement

2) What does the balance sheet show?

Answer: b) A snapshot of assets, liabilities, and equity 3) How are qualified dividends usually taxed? Answer: a) At the long-term capital gains rate Exercise Answers: Net Income = Income Statement Total Assets = Balance Sheet Cash from Operations = Cash Flow Statement

Additional resources

This section contains helpful links to related content. It isn’t required, so consider it supplemental.

-

It looks like this lesson doesn’t have any additional

resources yet. Help us expand this section by contributing

to our curriculum.