RAISECOM TECHNOLOGY CO.,Ltd.

603803.SS

Price:

$11.15

Market Cap:

$4.74B

RAISECOM TECHNOLOGY CO.,Ltd. researches, develops, manufactures, supports, and markets network devices and access solutions worldwide. The company offers IP MPLS systems; micro/pico/femto cell devices; smart home routers; multi-service access platform, such as packet transport network (PTN) aggregation platforms, multi-service chassis and modem chassis, multi-service terminal mux, and single/double slot chassis products; network management systems; and optical transport network systems. It also provides industrial switches, 3G/4G routers, and IoT gateways; GPON/EPON network products; and carrier Ethernet switches and demarcation devices. In addition, the company offers solutions for service ...[Read more]

Industry

Communication Equipment

IPO Date

2017-04-20

Stock Exchange

SHH

Ticker

603803.SS

PE Ratio

[-46.46]

ROE

[-6.57%]

Current Ratio

[2.13]

Dividend Yield

[0%]

Enterprise Value

[4.62B]

Dividend History

The Current Ratio as of December 2025 (TTM) for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) is 2.13

According to RAISECOM TECHNOLOGY CO.,Ltd.’s latest financial reports and current stock price. The company's current Current Ratio is 2.13. This represents a change of 2.22% compared to the average of 2.08 of the last 4 quarters.

RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) Historical Current Ratio (quarterly & annually)

How has 603803.SS Current Ratio performed in the past?

The mean historical Current Ratio of RAISECOM TECHNOLOGY CO.,Ltd. over the last ten years is 2.28. The current 2.13 Current Ratio has changed 9.22% with respect to the historical average. Over the past ten years (40 quarters), 603803.SS's Current Ratio was at its highest in in the December 2020 quarter at 3.18. The Current Ratio was at its lowest in in the March 2016 quarter at 0.

Average

2.28

Median

2.01

Minimum

1.88

Maximum

3.18

RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) Current Ratio by Quarter and Year

Discovering the peaks and valleys of RAISECOM TECHNOLOGY CO.,Ltd. Current Ratio, unveiling quarterly and yearly fluctuations to gain insights into the company’s financial performance and market dynamics, offering valuable data for investors and analysts alike.

Maximum Annual Increase = 44.55%

Maximum Annual Current Ratio = 3.18

Minimum Annual Increase = -36.77%

Minimum Annual Current Ratio = 1.88

| Year | Current Ratio | Change |

|---|---|---|

| 2024 | 2.00 | -0.15% |

| 2023 | 2.00 | 6.40% |

| 2022 | 1.88 | -6.40% |

| 2021 | 2.01 | -36.77% |

| 2020 | 3.18 | 19.71% |

| 2019 | 2.66 | 11.23% |

| 2018 | 2.39 | -13.93% |

| 2017 | 2.77 | 44.55% |

| 2016 | 1.92 | -4.76% |

| 2015 | 2.02 | -2.27% |

RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) Average Current Ratio

How has 603803.SS Current Ratio performed in the past?

The current Current Ratio of RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) is greater than its 3-year, less than than its 5-year, and less than than its 10-year historical averages

3-year avg

1.96

5-year avg

2.21

10-year avg

2.28

RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) Current Ratio vs. Peers

How is 603803.SS’s Current Ratio compared to its peers?

RAISECOM TECHNOLOGY CO.,Ltd.’s Current Ratio is less than Sichuan Tianyi Comheart Telecom Co., Ltd. (5.32), greater than Sunsea AIoT Technology Co., Ltd. (0.80), greater than Suzhou Keda Technology Co.,Ltd (1.65), greater than Shenzhen Aoni Electronic Co., Ltd. (1.86), greater than Shenzhen CDL Precision Technology Co., Ltd. (1.19), less than Chengdu KSW Technologies Co.,Ltd. (9.31), greater than Guangdong Champion Asia Electronics Co.,Ltd. (0.69), greater than Zhongfu Information Inc. (1.89), less than Bright Oceans Inter-Telecom Corporation (4.97), greater than Hengxin Shambala Culture Co.,Ltd. (1.32),

| Company | Current Ratio | Market cap |

|---|---|---|

| 5.32 | $3.89B | |

| 0.80 | $4.03B | |

| 1.65 | $5.24B | |

| 1.86 | $4.68B | |

| 1.19 | $3.87B | |

| 9.31 | $4.30B | |

| 0.69 | $5.43B | |

| 1.89 | $4.73B | |

| 4.97 | $4.37B | |

| 1.32 | $3.24B |

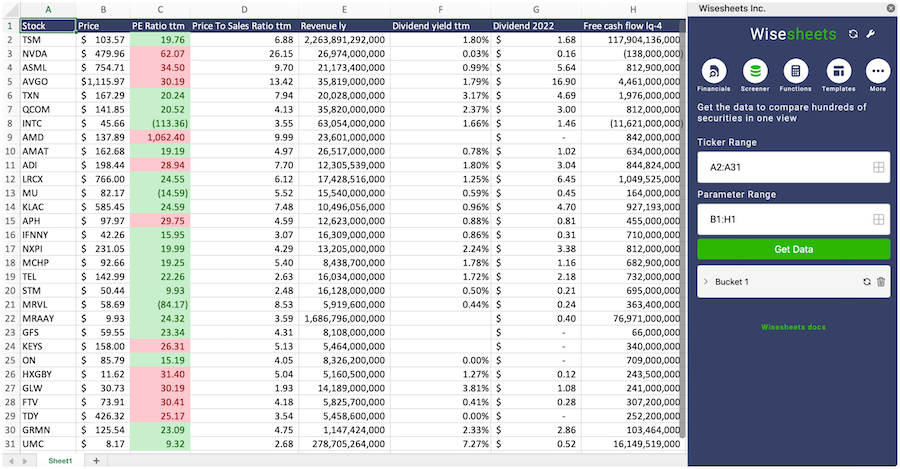

Build a custom stock screener for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) and other stocks

One of the best ways to find valuable stocks to invest in is to build a custom made screener in your Excel or Google Sheets spreadsheet. This allows you to compare thousands of companies like RAISECOM TECHNOLOGY CO.,Ltd. using the financials and key metrics that matter to you in a single view.

The easiest way to set this up is to use the Wisesheets add-on and set your spreadsheet like this:

Covering all these metrics from financial, data, dividend data, key metrics and more you can get all the data you want for over 50+ exchanges worldwide.

Get your free trial here.

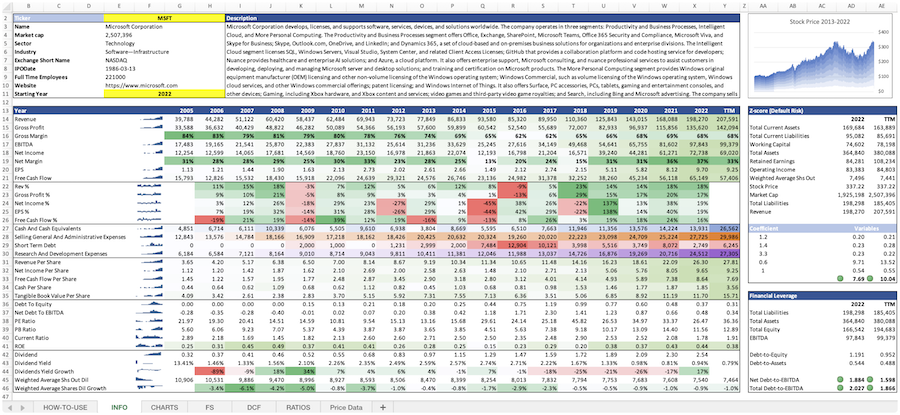

RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) and other stocks custom spreadsheet templates

The easiest way to analyze a company like RAISECOM TECHNOLOGY CO.,Ltd. or any others is to create a spreadsheet model that automatically retrieves all of the stock data you need.

Using Wisesheets you can set up a spreadsheet model like this with simple spreadsheet formulas. If you change the ticker you can get all of the data automatically updated for you.

Whether you need live data, historical price data, financials, dividend data, key metrics, analyst estimates, or anything else...Wisesheets has you covered.

Frequently asked questions❓

What is the Current Ratio?

How can you use the Current Ratio?

What is RAISECOM TECHNOLOGY CO.,Ltd.'s Current Ratio?

How is the Current Ratio calculated for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS)?

What is the highest Current Ratio for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS)?

What is the 3-year average Current Ratio for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS)?

What is the 5-year average Current Ratio for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS)?

How does the current Current Ratio for RAISECOM TECHNOLOGY CO.,Ltd. (603803.SS) compare to its historical average?